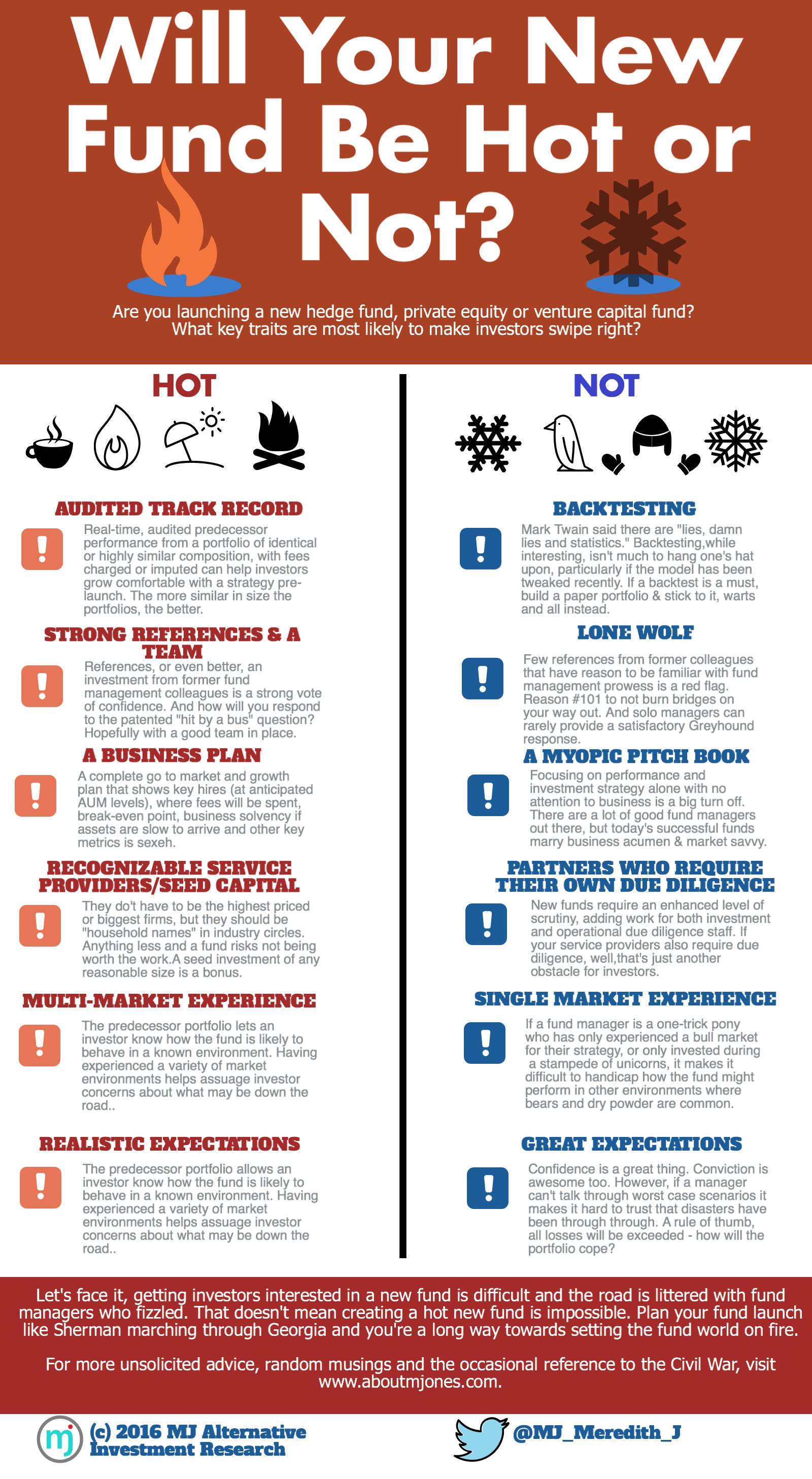

How many times have you sat through a panel presentation at an investment conference only to be bored out of your damn mind by one session or another?

The topic of the session doesn’t matter. It can be a session on anything from the tax treatment of investments to investors writing actual checks to fund managers on stage - investment porn if you will.

Indeed, there is only one thing that can kill a panel discussion faster than Raid kills roaches: overwhelming consensus.

“I agree with the prior panelists that (restate what you’ve just heard).”

“I agree with the prior three panelists that (restate again what you’ve just heard two times already).”

“Bob, do you have anything to add here?” “Well, I actually agree with Pat and Mary and that gentleman in the audience…”

C’mon, you know you’ve been there. And whether you’re in the audience or actually on the conference stage, a part of you wants to pick up a chair, throw it, and start chanting “Jer-ry! Jer-ry! Jer-ry!”

Ok, maybe that’s just me.

Now don’t get me wrong, generally I’m a fan of consensus. Consensus over where to eat dinner, what bottle of wine to order, whether or not a particular outfit makes my butt look big - these are good things on which to have input and universal agreement.

But when it comes to investing, I look for a few renegades, rogues and innovators and prioritize utility over unanimity, potential benefit over style and strategy boxes, because that's where excess value lives.

Last week, Palgrave, the publisher of my 2015 tome Women of the Street: Why Female Money Managers Generate Higher Returns (And How You Can Too), and I launched a Twitter poll. Roughly 130 Tweeters (Twitterers?) responded to the question: “Why do you think gender diversity is important in investing is important?”

This multiple-choice poll offered the following options for answers: Underrepresentation, Higher Returns, Diverse Behavior/Views, and Not Important.

The winning answer (39%) in the poll was “Diverse Behavior/Views”, which was great because that’s essentially my book in a nutshell, and I love the smell of validation in the morning.

I was, however, somewhat stunned that the second most popular answer (30%) was “Not Important.”

Uh, what? How can diverse views and behavior NOT be important in this industry? After all, the investment industry is overwhelmingly Caucasian, male and 35+, and the fund landscape (no matter what the asset class) is dominated by a few large investment firms …and if that ain’t a prime breeding ground for painful consensus, I don’t know what is.

Look, it’s undeniable that some level of consensus is necessary in investing (otherwise you will own a stock, company, bond or other instrument that never increases in value 'cos no one agrees with you about the value), but when we drift towards overwhelming consensus, I believe our ability to make money is diminished. And nothing pisses me off like missing out on returns.

Let’s take venture capital, for example.

- Data from the Martin Prosperity Institute shows that 25.3% of venture capital is invested in San Francisco/San Jose.

- Data from Forbes/Statista shows that 36.2% of venture capital is directed towards software companies, with another 17.3% going into biotechnology.

- And data from PitchBook shows that 45% of venture capitalists with MBAs matriculated from Harvard, Wharton or Stanford.

That's a whole heapin' helpin' of consensus.

To oversimplify a bit, that means you end up with a Venn Diagram of geography, network and industry that looks a lot like the one below, where anything that is overlapping spells some level of competition (higher valuations, similar concepts, etc.).

(c) 2016 MJ Alts

But start to change even one thing around and you could end up with increased opportunity. What if you look at the same industries and you went to Harvard, but you focus on, I don’t know, the Southeast, for example? Would it make sense that you might find some highly interesting investments that others might not, or are all the good ideas on the coasts? Or maybe you change your network. With so little capital directed to women and minority entrepreneurs, what if you cultivated a different network (or hired people with differentiated networks) to find out-of-the-box opportunities? Could that open up a new avenue for excess returns? The capitalist in me says, “Yes!” Differences can be good.

(c) 2016 MJ Alts

The same types of things happen in other parts of the investment spectrum, too. I’ve discussed in prior blogs research showing that long-only “benchmark huggers” have less chance of outperformance, (http://www.aboutmjones.com/mjblog/2016/5/3/kicking-the-buckets) and if you think about it, the same should generally be true for hedge funds.

For example, equity hedge funds make up roughly 30% of the overall hedge fund universe by number, and roughly 40% by assets under management. Many of these funds focus on US investment markets, and the vast majority are also managed by white males. This creates a universe of funds that potentially has a similar universe of investment opportunities, similar information available and similar behavior patterns, which can limit outperformance. By modifying one aspect, behavior for example, could we open ourselves up to a differentiated or even higher return? What if we looked at *truly* different strategies? What if…?

(C) 2016 MJ Alts

(c) 2016 MJ Alts

Now, don’t get me wrong. I am not anti-anything that generates (or exceeds) my expected return, and the reason that assets tend to concentrate the way they do is that those firms, industries, strategies, etc. often have a history of success.

But as an industry watcher, I can’t help but wonder what kinds of returns would be possible if investors and asset management firms changed their perspective just a bit and took a road less traveled every once in a while. If we wondered less about how much an investment or new hire or strategy looks like past success and instead asked how it is differentiated and could contribute to our overall success. I’m guessing we’d end up with increased diversification, higher returns and a myriad of other tangential benefits, not the least of which is fewer torturous panels.

Sources:http://www.theatlantic.com/technology/archive/2016/01/global-startup-cities-venture-capital/429255/ , http://www.forbes.com/sites/niallmccarthy/2016/06/27/which-industries-attract-the-most-venture-capital-infographic/#4b07db986778, https://pitchbook.com/news/articles/harvard-4-other-schools-make-up-most-mbas-at-pe-vc-firms