In case you missed any of my snappy, snarky blogs in 2014, here is a quick reference guide (by topic) so you can catch up while you gear up for 2015. My blog will return with new content next Tuesday – starting with my "New Year’s Resolutions for Managers and Investors."

“How To” Marketing Blogs

http://www.aboutmjones.com/blog/2014/12/8/anatomy-of-a-tear-sheet

http://www.aboutmjones.com/blog/2014/11/12/emerging-manager-2015-travel-planner

http://www.aboutmjones.com/blog/2014/10/21/conference-savvy-for-investment-managers

http://www.aboutmjones.com/blog/2014/9/11/ten-commandments-for-pitch-book-salvation

http://www.aboutmjones.com/blog/2014/7/18/emerging-managers-the-pitch-is-back

Risk

http://www.aboutmjones.com/blog/2014/11/10/look-both-ways

http://www.aboutmjones.com/blog/2014/11/3/the-honey-badger

General Alternative Investing

http://www.aboutmjones.com/blog/2014/10/25/earworms-and-investing

http://www.aboutmjones.com/blog/2014/10/7/alternative-investment-good-newsbad-news

http://www.aboutmjones.com/blog/2014/9/17/pay-what

http://www.aboutmjones.com/blog/2014/7/21/investing-and-the-law-of-unintended-consequences

“The Truth About” Animated Blogs – Debunking Hedge Fund Myths

http://www.aboutmjones.com/blog/2014/10/13/the-truth-about-hedge-fund-correlations

http://www.aboutmjones.com/blog/2014/9/6/the-truth-about-hedge-fund-performance

http://www.aboutmjones.com/blog/2014/8/8/the-truth-behind-hedge-fund-failures

Diversity Investing

http://www.aboutmjones.com/blog/2014/12/8/getting-an-edge-in-private-equity-and-venture-capital

http://www.aboutmjones.com/blog/2014/11/21/the-simple-case-for-emerging-managers

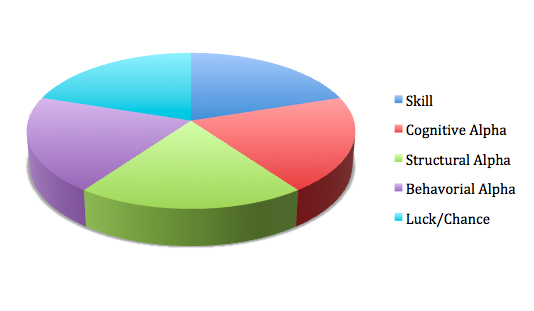

http://www.aboutmjones.com/blog/2014/9/29/mi-alpha-pi-a-look-at-the-sources-of-alpha

http://www.aboutmjones.com/blog/2014/7/21/affirmative-investing-putting-diverse-into-diversification

Private Equity and Venture Capital

http://www.aboutmjones.com/blog/2014/12/8/getting-an-edge-in-private-equity-and-venture-capital

Emerging Managers

http://www.aboutmjones.com/blog/2014/11/21/the-simple-case-for-emerging-managers

http://www.aboutmjones.com/blog/2014/11/12/emerging-manager-2015-travel-planner

http://www.aboutmjones.com/blog/2014/9/29/mi-alpha-pi-a-look-at-the-sources-of-alpha

http://www.aboutmjones.com/blog/2014/8/25/submerging-managers