Every Thursday there is a crisis at my house. A big one. It involves Hollywood movie scale running, hiding and yelling. The best FX team has nothing on the Matrix-like special effects that go on Chez MJ. And I can always tell the crisis is starting when I see this:

Yes, my Thursday Crisis is the Invasion of the House Cleaners. It’s scary stuff because, you know, vacuums and rags and spray bottles (oh my!).

How my cats learned to anticipate the Thursday Crisis is beyond me. I suppose there are subtle clues. I get up a little earlier to pick up and unload the dishwasher. (No judgment! I bet if I did a scientific poll about people who clean before their maids arrive the results would show I’m in the majority). I make a least one trip to the laundry room to grab clean sheets and towels. Whatever it may be, Spike and Tyrone have learned to watch for Thursdays with the diligence of Jack Nicolson guarding us against Cuban communism in A Few Good Men (“You can’t handle the vacuum!”).

For the rest of us, watching for the next financial crisis is a bit more nuanced. Last week, for example, I read two articles that made me wonder if we even understand what a crisis is, or if we all believe financial panic is as predictable as my housecleaners’ arrival.

The first article looked at the state of venture capital in the U.S. New figures, released by PriceWaterhouseCoopers and the National Venture Capital Association showed that venture capital investments in companies reached $17.5 during the second quarter of 2015, their highest totals since 2000. However, the article argued that, given that the total projected investment for 2015 (more than $49 billion) was less than the total amount invested in 2000 ($144 billion) and that the number of deals is lower as well, it couldn’t be another tech wreck-venture capital bubble in the making.

The second article looked at the risk precision of Form PF – a document introduced post-2008 to better understand and measure the risks created by hedge funds. The article cited two instances where hedge funds had proven their ability to destabilize economies: George Soros’ attack on the GBP in 1992 and Long Term Capital Management, the first "too big to fail", in 1998. Given that the hedge fund industry is now much larger than it was during those two “crisis”, it of course stands to reason that the risks created by hedge funds are now exponentially greater as well.

Or are they?

Both articles were extremely interesting and presented compelling facts and figures, but they also were intriguing in that both seemed to assume that, at least in part, we experience the same crisis repeatedly. That perhaps we have a financial boogeyman waiting outside of the New York Stock Exchange every Thursday, much like my housecleaners.

But the reality is, a crisis is often a crisis precisely because we don’t see it coming. Each meltdown looks different, however subtly, from the one that went before. Which begs two questions:

- Are we always slamming the barn door after the horses are gone?

- And going forward, are we even worried about the right barn door?

Let’s look at a few financial meltdowns as examples.

1987 – Largely blamed on program trading by large institutions attempting to hedge portfolio risk.

1990s – Real estate crisis caused by market oversupply.

1998 – Asian markets (1997) plus Russia plus Long Term Capital Management– a hedge fund leveraged out the ying yang (technical term).

2000-2002 – The tech wreck. Could be blamed on “irrational exuberance”, changes to tax code that favored stocks with no dividends, or excessive investment in companies with no earnings (or products in some cases).

2008 – Credit meltdown created largely by overleveraged consumers and financial institutions. Real estate crisis created by demand (not supply).

2011 – Sovereign credit issues, not a total meltdown obviously, but noticeable, particularly in many credit markets.

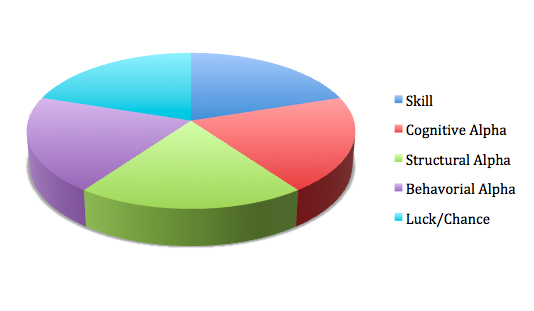

While these are gross oversimplifications of each period, it does show a clear pattern that, well, there ain’t much of a clear pattern. Bubbles happen largely due to macro-economic investor psychology. Everyone jumps on the same bandwagon, and then decides to jump off at roughly the same point. Think of it as Groupthink on a fiscal level. It isn’t easy to break away from Groupthink and it’s often even harder to spot, given that we’re often part of the group when the bubble is building.

So what’s the point of this little rant? Do I think we’re at a new venture capital bubble? I don’t know. The market has changed dramatically since 2000 – crowdfunding, Unicorn Watch 2015, lower costs for startups, and shows like “Shark Tank” are all evidence of that, in my opinion. And are hedge funds creating systemic risk in the financial markets? I don’t know the answer to that question either, but ETFs have now eclipsed hedge funds in size and robo investors are gaining ground faster than you can say “Terminator,” and LTCM was nearly 20 years ago, so it seems unlikely that hedge funds are the sole weak spot in the markets.

I guess I said all that to say simply this: If we spend too much time trying to guard ourselves against the problems we’ve already experienced, we’re unlikely to even notice the new danger we may be facing. If my cats only worry about Thursdays, what happens if the plumber shows up on Tuesday? Panic. If you drive forward while looking behind you, what generally happens? Crash.