NB - I have nothing against crypto and quant funds, honestly, but a little variety is always nice.

It seems as if everyone has been pretty focused on Tweets, hashtags, and the general dumbing down and coarsening of communication of late. So I thought this week I'd inject a little culture into my investment blog. What if investors and fund managers could only think or talk in Haiku? The sentiments would likely remain the same, but the delivery might be much more civilized. So here you go: investor and manager haikus. Feel free to add your own in the comments section.

Investor Haikus

Seasons change, my phone

Keeps ringing. The same number

Calls. Persistent funds.

Not the best idea

To use diligence checklist

On the kids’ playdates.

Must I disclose this

Doughnut to compliance or

Can I eat it all?

Can’t wait to discuss

Fees with the trustees at our

Next board meeting. Yay.

I don’t want to shake

Hands while grabbing paper towels

In the bathroom. Gross.

Manager Haikus

Fall becomes Winter,

And I find myself stuck in

Endless diligence.

Performance is great!

This sector is hot! So why

Don’t people subscribe?

Do you want info

On my investment fund? No?

Maybe tomorrow?

Families, pensions,

High net worth peeps, endowments.

Lather, Rinse, repeat.

Competitive edge?

It’s our process and people!

Oh. You’ve heard that one.

I seem to provide this information to newer and smaller funds often, so I thought I'd cut down on repetition and provide all you gorgeous small, new, and diverse fund managers with a short guide to early stage investors. Now start smiling and dialing!

(c) 1980 Paramount Pictures

State Plans To Prioritize

Arizona - Has made at least one investment in a large 'emerging' manager.

Arkansas - Teachers Retirement System reportedly tabled the program in 2008 but 2011 document shows active investments in MWBE managers.

California - Looks for EM's based on size and tenure but prohibited by Prop 209 from looking at minority status or gender.

Colorado - Colorado PERA added an "external manager portal" in 2016 to make "it easier for us to include appropriate emerging managers when the right investment opportunities develop."

Connecticut - Based on size, minority status or gender. Awarded mandate in 2014 to Grosvenor, Morgan Stanley and Appomattox.

Florida - Looks at emerging managers on equal footing with other managers.

Georgia - Invest Georgia has $100 million to work with venture capital and private equity firms in the state. There is an emphasis on emerging managers and emerging funds per press reports.

Illinois - Perhaps the most active emerging manager state, based on gender, minority status and location.

Indiana - Based on size, minority status, or gender.

Kentucky - Reported $75 million allocation at one time.

Maine - Has made at least one investment in a large 'emerging' manager.

Maryland - Very active jurisdiction with details available online for gender and minority status manager information.

Massachusetts- Includes size, minority status or gender.

Michigan - $300 million program.

Missouri - Status based on size.

Minnesota - Past investments in emerging managers.

New Jersey - Status based on size.

New York - Status based on size, minority status or gender. $1 billion mandate in 2014. $200 million seed mandate in 2014.

North Carolina - Status based on size and HUB (minority and women owned) status.

Ohio - Status based on size, minority status or gender.

Oregon - Emerging manager program in place.

Pennsylvania - Status based on size with preference for minority or women run funds.

Rhode Island - Plan in place from 1995.

South Carolina - Status based on size.

Texas - Actively engaged with emerging managers. Status based on size, minority status or gender.

Virginia - Status based on size, minority status or gender.

Washington - Has issued prior emerging manager RFPs.

Oh, and if you reproduce this list, be sure to cite MJ Alts. Thanks y'all!

Seed Programs to Explore

https://www.hfalert.com/documents/FG/hsp/hfa-rankings/575025_Backers.pdf

Music to Groove To While Dialing for Dollars

(c) 1988 Bull Durham

Anyone who has spent any time talking to me or reading my blogs knows I love a good movie. Although I don’t see as many as I’d like these days, I love how a film can transport you, inspire you, create emotion and just generally entertain. I even use the love of a particular film as a kind of odd litmus test in friendship, business and dating situations. Did you adore Forrest Gump? Yeah, that makes me seriously question your judgment.

But some movies stand out more than others in the MJ Pantheon of Favorite Flicks. Star Wars (the original trilogy, natch), Shawshank Redemption, Argo, Bridesmaids, The Blind Side (don’t judge me), The Wolf of Wall Street, The Princess Bride, 50/50, Raiders of the Lost Ark, Rudy, Love Actually, Aliens, The Terminator (1 & 2), Die Hard and Pride & Prejudice (the 2005 version) are just a few of my all-time faves.

And of course, there’s Bull Durham. Though I’m not a huge fan of baseball (too slow, lots of spitting, often hot), I loved that movie when I first saw it at the ripe old age of 18. It was my first sophisticated on-screen romance, which had theretofore been populated by teen sex films (e.g. Porky’s), John Hughes offerings (Pretty in Pink, Sixteen Candles) and saccharine Disney scripts.

When Kevin Costner’s Crash Davis gave his epic speech during Annie Savoy’s, ahem “tryout” between Crash and Nuke LaLoosh (Tim Robbins), Susan Sarandon wasn’t the only one who sighed “Oh my…”

In case you haven’t seen Bull Durham since it’s original 1988 release (sacrilege!), here’s the scene in question. (And you may not remember this, but it is officially NSFW.)

Since we’re nearing the end of summer, I decided to watch my one and only cinematic homage to baseball over the long Labor Day weekend. It got me thinking about what I believe in when it comes to life and investing, and it wasn’t long before I was on an epic, Crash Davis-esque rant.

“I believe in manager skill. That checkbox due diligence only works if you also have a high EQ for evaluating people. That generalists and specialists should work together to combine the best aspects of myopia and a more holistic, 30,000-foot view. I believe that people who call themselves long-term investors, but who regularly redeem in less than 24 months, are full of crap. I believe that managers who say they can’t find diverse job candidates either exist in ridiculously insulated bubbles or have no imagination. I believe that having less than 10% of hedge funds, mutual funds, venture capital and private equity funds managed by women – who comprise 50% of the population – means we’re missing out on some amazing talent. I believe if all investment managers and all investors agreed to always interview a diverse candidate for jobs/fund searches, it would go a long way towards adding cognitive and behavioral diversity to the industry.

“I believe in downside deviation, maximum drawdowns and time to recovery. I think standard deviation is silly. I believe most investors don’t worry about upside volatility, but that out-of-character positive returns should trigger a monitoring phone call as fast as a losing month. I believe in macro funds, commodity trading advisors and short selling strategies, and that investors should consider these strategies before the proverbial shit hits the investing fan. I think hedging with index options isn’t real hedging, and that taking 8 to 12 months to complete due diligence is like wanting to get pregnant without risking actual sex.

“I think investment conferences should improve the quality of their cocktail party wine. That you should NEVER order the vegetarian option for lunch at an event unless you have a desire to eat something that looks like road kill. I believe in polite but persistent marketing. I think that if you focus on your expertise instead of a sale, you’ll amass greater assets under management (AUM). I believe you should always check time zones before calling a prospect or client, and that texting is NSFP (Not Suitable For Prospects).

“I believe in differentiated networks, niche strategies and cognitive alpha. I believe in gut feelings and spidey senses about people, markets, and investments. I believe in contrarians, and in sticking to your investment guns, as long as you periodically re-visit your thesis to ensure you’re not just stubborn. I believe going to cash takes testicular fortitude. I believe getting back into the market does, too. I believe in good business cards, firm handshakes and not approaching prospects in the bathroom.

“I believe that those funds that don’t get into responsible investing/ESG now will be licking AUM wounds in years to come. I believe that all investment managers make mistakes, and that admitting mistakes and ensuring that they don’t happen again is a mark in a manager’s favor. I believe in strategy continuity, but not necessarily in strategy drift. And that past performance isn’t indicative of future results, but it beats knowing nothing about how strategy translates into returns.

"I believe that most meetings could be emails, and those that cannot should be limited to one hour, tops. Oh, and any meeting that goes longer than one hour should involve snacks.

"Finally, I believe in small funds. New funds. Large funds. Old funds. Women run funds. Minority run funds. White guy run funds. Bread and butter funds. Niche funds. Liquid funds. Illiquid funds. And contrarian funds. I believe there is manager talent and fund utility in all types of funds, and that only by looking at the full menu can investor's hope to have a balanced portfolio meal."

Oh my!

So get back to work all. I hope you enjoyed my little investment rant…pith in the wind if you will. Maybe it will get you thinking about YOUR investment beliefs as we ramp back up into what I think could be a certifiably crazy fall market. Oh, and if you have an investment belief or rant of your own (or a good movie suggestions), feel free to sound off in the comments below.

The summer can be a magical time. Whether you’ve spent the past couple of months hanging out with family, taking a much needed vacation or getting sucked into the daily political dumpster fire in the U.S., most folks spend all of August (and most of July) focused on more leisurely pursuits. In the investment industry, not a lot gets done this time of year to be honest. But in just a few short weeks, watch out! The conference calendar will kick into overdrive, investors will start planning end of the year allocations (and redemptions) and you’ll need to jump back into capital raising and investor relations with both feet.

To help you make the switch from porch swings and gin and tonics to panel discussions and bad chardonnay, I’ve enlisted the help of Emoji MJ to give you your “back to school” checklist. Be sure you pay attention, class…Emoji MJ may be taller, thinner and have tamer hair than I (aside: Emoji MJ is clearly French), but I’ve still heard she can be a real beeyotch.

(c) MJ Alternative Investment Research

1) The first thing you need to assess is whether you have the right staff in place for your marketing and investor relations efforts. If you're a smaller fund, you may be pulling double duty as both portfolio manager and the marketing staff, but even then, you should take time to think about whether that's the best use of your time and, frankly, whether you're any good at raising assets. If you do have internal or external help, make sure they are a good fit for your firm and have great connections with potential investors. If you're wondering what questions you should ask, check out my blog on The Vicky Mendoza Line And Fund Marketers.

2) Your next order of business will be to compile an investor hit list. This means taking a hard look at who your best prospects may be. This does not mean creating a wish list of investors that could write you an enormous check so you don't have to think about capital raising again. If you're sub $100 million, that likely means thinking about how you can meet additional HNW individuals and family offices and maybe a MoM (Manager of Managers/Fund of Funds) or two. If you're in the big league, your prospecting will obviously look a little different. For those of you who need a refresher on this particular step, please revisit this blog on Targeting Potential Investors.

3) The third item on your "back to school" prep list is to revisit your pitch book. Make sure it works for you, whether you're walking an investor through it, sending it in advance or leaving it as a follow up. Your pitch book is really an extension of you, so make sure it is as compelling and complete as possible, without overloading unsuspecting prospects with superfluous (or uninspiring) information. If you need pointers on building the perfect pitch book, please check out The Ten Commandments for Pitch Book Salvation AND The Seven Deadly Sins of Pitch Books.

4) Got your pitch book nailed down? Good! Now practice how you're going to convey all that juicy info into one 5 minute elevator pitch. That's right...no investor, no matter how charming you are as a fund manager, is going to let you blather on to them endlessly at a cocktail party or during a conference break about your overall awesomeness, so now is the perfect time to perfect your pick-up lines. If you haven't given this much thought, or if your existing pitch isn't getting you to second base (actual non-conference contact with an investor), then take a moment to review these Seven Secrets to a Successful Elevator Pitch.

5) While you're doing a little pre-season homework, it's probably a great time to refresh your monthly letter and tear sheet. Do you know how many times I get just a nekkid monthly (or quarterly) performance number plus YTD performance in a bland email? It's not optimal. So review the proper Anatomy of a Tear Sheet as well as these Five Tips For Great Monthly Letters.

6) Conference season is about to go nuts. So in addition to picking up a gallon of hand sanitizer and some Tums (rubber chicken doesn't always digest well - and don't get me started on the vegetarian options at most events - WHAT ARE THOSE THINGS?!), you'll need to have a strategy. What conferences will you attend? How much can you spend? Speaking, sponsoring or showing up? You'll want to strategize to make the most of the time and effort you spend away from the office. To help you, check out these Conference Dos and Don'ts.

7) After you meet a ton of new investor prospects at conferences this fall, wow them with your elevator pitch, performance and pitch book, and send a few outstanding monthly letters, you'll need a plan for how you'll stay in touch with them going forward. I mean, as much as a fund manager would love it if an investor "put out" on the third date, in these due diligence times, that's pretty darn unlikely. So how do keep communicating without driving anyone batcrap crazy? Try these tips for Staying in Contact With Investors.

So good luck students! Emoji MJ and I hope you make the dean's list of capital raising this fall!

(c) Match.com

As many of you may have read in my last blog, I spent about six weeks of 2016 delving into the sometimes-smarmy world of online dating. One of the first lessons I learned, besides the liberal use of the “block” function, was that a picture of a potential match was not just a nice to have, but also a necessity.

(BTW, I swear to you all, this is the last time I will mention my horrifyingly brief online dating experiences. It’s not my fault that recent events have spawned a few Match.com flashbacks.)

You see, much of the descriptive language available to would-be daters is fairly subjective. Words like “Average” “A few extra pounds” and even “Athletic and Toned” mean different things to different people. Hell, even descriptive statistics that shouldn’t have been subjective were sometimes unpredictable. I mean, 37 years old means 37 years old, right? Yeah, unless it means 45, 47, or 50.

Before I became online dating savvy (read: scarred for life), I would sometimes have email conversations and agree to meet these faceless souls. I quickly learned that “Average” meant “A Few Extra Pounds.” “A Few Extra Pounds” heralded someone the size of my living room sofa. “Athletic and Toned” meant “Once Did A 5k.” “Salt and Pepper” translated to “Gray” and sometimes “Bald.” And “No Kids” could mean “No Kids,” “Some Kids” or “I’ve Been On Jerry Springer About My Kids.”

So you see, pictures of potential suitors could be helpful. They weren’t definitive – sometimes a picture was taken AT 37 and still utilized eight or more years later – but they were at least sometimes directionally correct.

Sadly, my professional life isn’t so different.

I spend a tremendous amount of time meeting with fund managers. Most of these managers are shiny and new, fresh-faced and full of faith that their first $100 million allocation is mere months away. They are the would-be suitors of the investment world, and they are here to get a first, second, and the all-important third date (bow chicka wow wow) with your capital.

Unfortunately, many of them are lacking the investment industry equivalent of a profile picture: Performance. Instead, they are asking potential investors to take it on faith that performance will be as described in their oh-so-earnest pitch books.

Only problem is, most investors have been on so many dates with fund managers at this point that they’re just a little bit dead inside. Faith isn’t on the menu, while skepticism is served at an all-you-can-eat due diligence buffet. We all know that past performance is not a guarantee of future results, just like a dating profile picture is no guarantee of recognizability in a bar, but at least it gives you some characteristics to look for.

So how do you solve a problem like performance?

1) Predecessor Performance – For a pre-launch fund manager, this is the gold standard of pseudo-track record. If you have performance from a prior fund management gig where you managed a decent chunk of change in substantially the same strategy with substantially the same investment team, it can be of tremendous help to investors. If the performance is audited and portable (meaning you’re not prohibited from using it by your former fund complex), so much the better. Again, past performance won’t necessarily be the same as your future results, but this provides at least a small window into how you may perform in different market environments and what type of drawdowns to expect (although my cold, Grinch-like heart says all drawdowns will be exceeded at some point). Make sure the fees are the same (or provide imputed fees in the same structure as the new fund) and that will satisfy some investors. Do know, however, that for every aspect of the prior track record that differs, there will be a credibility discount. Don’t have your former co-portfolio manager at the new fund? That’s an issue. Going from long-only to long-short? How do we know you can short? And so on and so forth...

2) Trade Your Own Account – For those that do not have access to a portable track record for whatever reason, you should start actively trading your strategy. Now. Actually yesterday. With real American dollars. While it is unlikely that the AUM will be similar (which will discount the performance with some investors) and while it will be a shorter track record in (likely) only one market environment, it’s something. It also shows that you believe in the strategy enough to stake your own financial future on it. Frankly, even if you have a portable track record, creating live performance ASAP makes some sense.

3) Paper Portfolios or Backtests – This is obviously not optimal. In my (too frequently offered) opinion, paper portfolios are only appropriate if you trade a strategy where need substantial AUM to proceed (for ISDAs, etc.). Otherwise, you’re just announcing that you’re not willing to put your own skin in the game. And backtests can be gamed in any number of ways. After all, it’s always easier to plot a course if you know where you’re going to end up. Of course, there are very few investors who will allocate based on backtested or paper portfolio performance alone, but if it’s the best you’ve got, then it is what it is.

I eventually set my online dating search criteria to “photos only.” That saved me a few headaches, although who knows if I missed “twue love” by avoiding as many frogs as possible. To minimize your chances of getting blocked completely by investors, and to maximize your chances of marrying your investment strategy with some AUM, try to proactively solve for performance sooner rather than later. Ideally, you’ll want to negotiate for your track record when leaving your prior firm, but if that’s not possible, do whatever you need to post returns. After all, a VAMI chart can be worth 1,000 words.

Yeah...so that happened...

Last August, I took my blog readers on a brief tour of my even briefer online dating struggles in an effort to prove that the behavioral bias WYSIATI (“what you see is all there is”) strikes indiscriminately, whether you’re a hedge fund investor or a hapless single gal. In case you missed that treasure trove of self-deprecation and BiFi, you can revisit it at http://www.aboutmjones.com/mjblog/2016/8/16/thank-god-what-you-see-isnt-all-there-is.

Since then, with the help of meditation, more than a few margaritas and some PTSD therapy, I have managed to put my online dating adventures behind me.

At least until this week, when I suddenly had an Apocalypse Now style flashback courtesy of an overly persistent investment marketer.

You see, during the roughly six weeks that I looked for love in the wrong online places, I attracted only three types of men: those who liked to hunt and kill things for sport (with pictures), those that liked to dress up and reenact the Civil War (also with pictures) and those that were old enough to be my dad. I won’t lie, sometimes I was lucky enough to find all three in one stunning candidate, but mostly they came in one flavor or another.

Surprisingly, the hunters weren’t the most persistent. Nor were the Civil War reenactors, who were, after all, really used to losing by now. Nope, it was the Very Old Dudes (VOD) that were the absolute worst when it came to tenacity.

The encounters were remarkably similar. I’d get a message that announced, usually without preamble, that

“I know you think I’m too old for you but you’re wrong. Love VOD”

After verifying that said gentleman had been eligible for AARP for roughly half of my not-insignificant lifespan, I would click ignore and move on. Inevitably, I would get a second email.

“I’m still not too old for you. XOXO VOD”

Why yes, sir, in fact you are. Delete.

And finally –

“You should know that everyone thinks I’m very young for my age. #VOD”

After I deleted my Match.com account, I rested comfortably in the knowledge that I could avoid more of these types of sales pitches in the future. Until last week. When an investment sales rep used the exact same shtick.

“Hi! I got your name from [the Match.com of investors, evidently]. You don’t know me, but I thought you might be interested in this investing opportunity that is completely out of left field.”

I was traveling so I ignored the email for a few days, only to get a voice mail.

“Oh hi! I sent you an email about this very random investment opportunity a few days ago. Call me back so we can chat about it.”

Because I generally try to respond to all investment inquiries, save those from Nigerian princes, I reviewed the material (briefly) and emailed the gentleman back to politely let him know it wasn’t for me. His response?

“May I ask why you’re not interested? It’s a great opportunity.”

Ugh, I thought, this is what I get for being nice. I wrote back a two-sentence email about why I wasn’t interested.

“I’m sorry, but I don’t have a positive forward view on this sector and I am a fund investor not a direct investor, generally speaking. Good luck again with your efforts.”

Of course, I thought that was that. But I was wrong.

What came next was a flurry of information about why my view of the investment opportunity was wrong, any doubts I had about the viability of the sector going forward were likewise incorrect, and how everyone thought this was a great investment opportunity.

My response? Well, I didn’t write one, because at that point I just blocked said marketer, but seriously?!? Does that sales pitch ever work? Do you get anywhere with people by telling them they’re wrong, deluded or just plain silly to not think the same way you do? Oh, and if everyone thinks it’s a great investment, why do you need to badger me, Sparky?

You may think this particular sales pitch is unique, but it happens more often than you realize. I probably have at least two or three conversations with fund marketers along these lines each year, and a larger number that are more subtle, but essentially from the same playbook. Yep, it’s a veritable treasure trove of email exchanges, phone calls or meetings where someone I don’t know’s passion for the investment strategy and certainty of its success is supposed to overcome any logical objection or lack of interest on my part.

It. Never. Works.

There has never been a moment when, on the spur of the moment, I’ve exclaimed “Gee willikers! You’re so right! How could I not have seen how wonderful this opportunity is before now! You’re so smart and patient (not to mention handsome – Oops! that’s online dating world flashback again…) to take time to school me on this. Let me send you a wire RIGHT NOW.”

This is not to say I’ve never changed my mind about a fund, but it has literally never been a “Road to Damascus” moment. There is often a catalyst or a period of prolonged and thoughtful study/review that leads me to reverse course.

In fact, the more someone discounts a reasoned opinion, the more intractable I become. And it sometimes, as in the case last week, can even lead to the capital raising penalty box – aka my junk mail folder.

So to all you fund marketers out there, and managers who pull marketing double-duty, take a moment to think through your last several pitches. How did you handle questions, objections and strategy pushback? Did you slow your roll or attempt to “sell” the idea anyway? If you pushed for the sale, you may find yourself without a date to the AUM dance. Everyone wants to know that they’re heard. By not picking up what an investor is putting down, you’re telling them, either in as many words or more subtly, that what they think doesn’t count - only what you think matters. Taking a step back, and a more educational and collegial tone, may take longer, but it can yield more fruit in the end.

And fund managers, to the extent that you rely on others to do your capital raising and marketing, take a moment every now and again to listen to your marketer’s pitch. Make sure it’s how you want your fund and your personal brand represented, so your personal assets don’t get too lonely in your fund.

(c) IFC.com

In 1972, George Carlin first performed his now infamous Seven Words You Can Never Say On Television. In case you’ve never watched it, this hilariously foul yet informative bit of comic genius provided clarity around the words that could be used on TV and in polite society, as well as some noteworthy use cases. It was both provocative and spot on, so much so it was later used as the basis of a 1978 Supreme Court case (Federal Communications Commission V. Pacifica Foundation) that still governs the use of “obscene” language on television.

In the skit, Carlin famously laments that no one tells you what the 7 deadly words are, and that as a kid, you simply use them and get slapped, providing your clues as to what constitutes acceptable public language.

Unfortunately, the same is true for money managers. It seems no one has officially shared with them the language that is and isn’t acceptable for use with potential investors. So, rather than letting them get slapped around (or waiting for a Supreme Court ruling), I thought it might be helpful to review the Seven Phrases You Can Never Say In Pitch Books.

1) “Our goal is to generate excess returns over a three to five year period with less volatility than the index.” C’mon people. Surely you can do better than this lawyerly non-speak? What on earth does an investor learn about your fund from this phrase? And frankly, how on earth is it different than any other fund on the face of the planet? Do you think that there are funds that write “our goal is to underperform the index over the long haul?” Obviously promising specifics, particularly pie-in-the-sky performance targets, can get you in a heap of trouble with both investors and regulatory bodies, but if you can’t be more specific than this, just do without.

2) “A significant portion of the manager’s assets are investing in the Fund.” This is a tricky one. Frankly, no investor is going to invest with a manager who isn’t eating their own cooking, so it’s worth saying. But because managers’ are savvy to this, almost none of them would be silly enough to NOT invest in their own fund, rendering the phrase fairly ubiquitous. In addition, if the fund is super small (<$5 million), investors are going to wonder if there’s any outside capital in the fund. And finally, why aren’t all of the manager’s liquid assets in the fund? What is the definition of “significant?” Do other fund personnel have skin the game? This generic statement frankly raises more questions than it answers.

3) “Our team has 150 thousand years of combined investing experience.” Yeah…about that. What really matters when it comes to experience is that this isn’t your first rodeo and that you’ve in fact been to more than one over the years. If you’ve only seen one market cycle, bulking up experience levels by compounding it with your CFO, COO, IR and other senior staff is pretty hollow. If you’ve been around the block a time or two, maybe you should highlight the trigger-puller's specific experience, not that of the entire team?

4) “Our competitive advantage is our bottoms-up research.” Two things here. One – bottoms up is a toast, not a research methodology. Two – don’t you think every manager can say the same thing in a way? Do you think there are managers who write: “we just make freaking guesses or pick companies based on whether we like their advertisements?” If you can’t point to something that makes your process truly unique, you may be in trouble.

5) “We use quantitative and qualitative screening as part of our investment selection process.” Again, you and almost everyone else, buddy. Can you be a bit more specific here? How does the quantitative screen work? What factors does it consider? Is it proprietary? How long has it been in use? Has it seen more than one market cycle? Who maintains it?

6) “We run a high-conviction portfolio.” This is actually a fine statement, if you are actually running a concentrated, high-conviction portfolio. For the record, if you have 30-40 investments or more, you ain’t.

7) Quotes by anyone. Including you. Your pitch book isn’t the place to be quoting other investors, economic theory or (true story) the Bible. It’s the place where you describe, in as precise yet glowing terms as possible, who you are, what you do, why you’re good at it and what your results have been. Period. Anything else is a distraction. If an investor wants to read some pithy quotes, that’s what the Internet is for. Oh, and quoting yourself…seriously?

So there you have it folks, the Seven Phrases You Can Never Use In Pitchbooks. Heed them, or risk getting slapped around by potential investors.

And for those that would like a trip down dirty word memory lane, here's a link to the infamous Carlin skit. NSFW. https://www.youtube.com/watch?v=kyBH5oNQOS0

Dialing for dollars. It was all so much easier before Caller ID.

Now money managers have to wonder "Have I called too much?" and "Is now a good time to talk?" and "Is this investor ever going to pick up the damn phone?"

While investors fret "Will this fund manager ever stop calling me?" and "Sacramento...who do I know in Sacramento?" and "If I let it go to voice mail one more time, does that make me a bad person?"

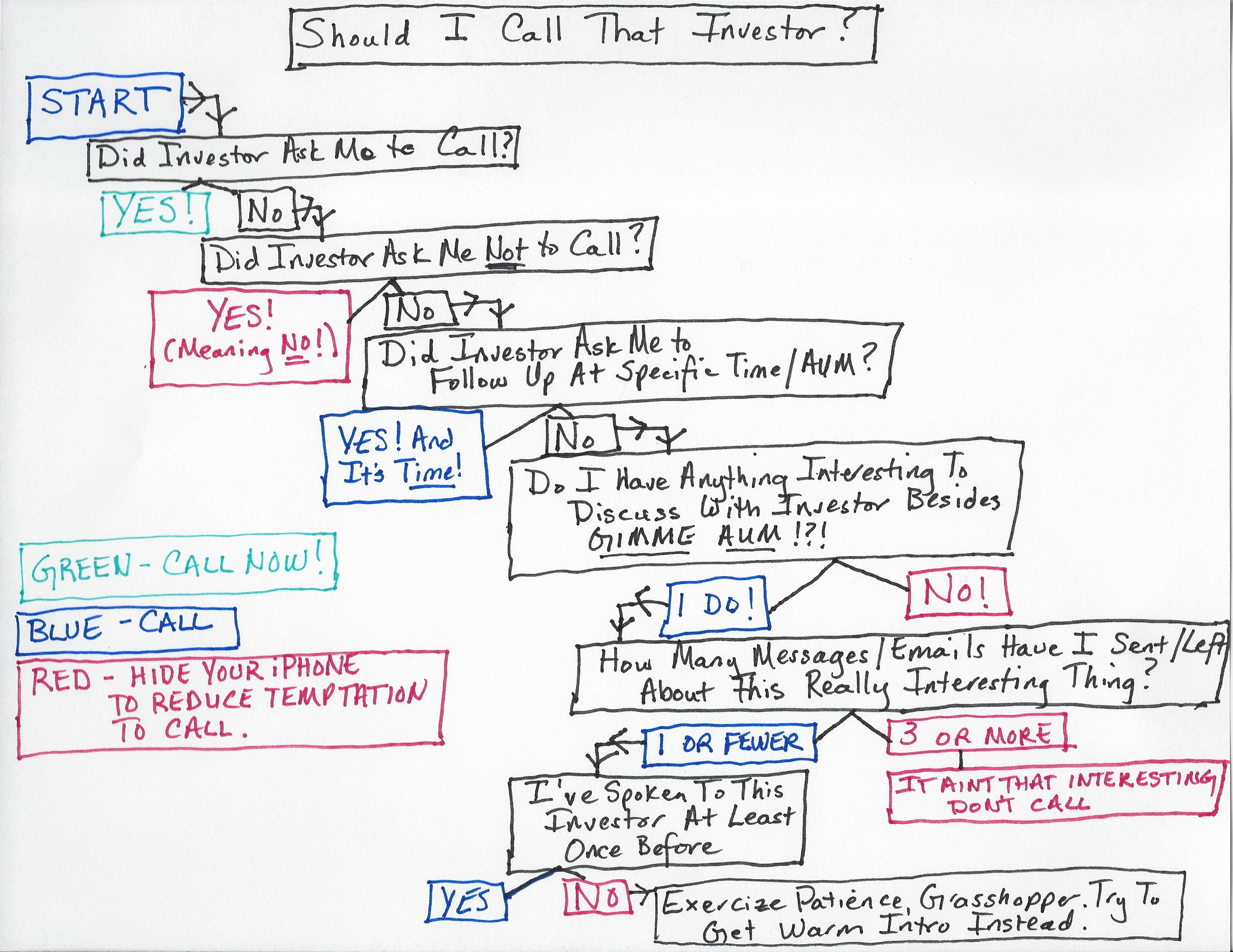

To help investors and managers navigate the tricky capital raising call landscape, I've created the following decision trees to help fund managers know when it's ok to call, and when investors should (and shouldn't) pick up.

Happy smiling and dialing! And may the odds be ever in your favor!

(c) 2017 MJ Alternative Investment Research

(c) 2017 MJ Alternative Investment Research

(c) 2009 Mandate International "Whip It"

I recently started training to become a roller derby referee.

You read that right. In my spare time, I plan to sport a really loud whistle and to wear a black and white striped shirt with my chosen roller derby moniker emblazoned on the back. Bonus points for the loyal reader who guesses what that might be.

You see, I’ve been a fan of roller derby for years. I loved the movie “Whip It” and, shortly after seeing it for the first time, discovered that Nashville has its own Rollergirls team. I’ve been going to bouts ever since. Mock me if you will, but I would argue that there are few better evenings of sports entertainment to be had. It’s cheap. There are nachos and beers bigger than my head. In addition, roller derby names bring in a hefty dose of humor - one opposing team actually had a player named, I kid you not, “The Other White Meat.” Basically, it’s all around good, clean fun, with just a hint of sex and violence. How can you lose?

On my first night of official practice, I realized that all of my beer-fueled nights of watching roller derby had ill prepared me for actual officiating. While I was familiar with the basic rules, there were dozens of arcane guidelines that one would never notice from the stands. For example, a player sitting or standing in the penalty box can remove their mouthguard, but if they skate towards the track with it out, that’s a penalty. Skaters choose their own one- to four-digit player number, which are always said as individual digits (Player 1-3-3-7 versus Player 13-37). Luckily, breaking that rule won’t earn you a penalty, but it may merit a dirty look from a player named Winona Thud.

(c) 2009 Mandate International "Whip It"

Some of the rules, particularly ones I kept screwing up, seemed a little silly to me, and, being the Type A jerk I can sometimes be, I felt compelled to question a few. That earned me a few additional dirty looks. At one point the head official said, “yeah, it’s kind of peculiar, but that’s just the way it is.”

After I got home that night, I started thinking about the arbitrary rules in other parts of my life. Investing obviously has A LOT of very specific rules and regulations, most of which have been handed down by various regulatory bodies. Some of them make perfect sense to me (providing net versus gross performance to current and potential investors, for example), while some seem designed merely to make me crazy and to create and sustain compliance jobs.

But in addition to the codified (and omnipresent) regulations in investing, there are a host of informal norms and mores, as well as some basic unspoken tenets. And, at the end of the day, understanding the entire greasy burrito of investing lore is critical to navigating investment terrain without losing your sanity.

For example, even though there’s no rule (or glaring Rollergirl named “Lil Red Right Hook”) to dissuade them, most managers know by now NOT to make their pitch book too long, but what about color schemes? Did you know you generally shouldn’t have a red logo or typeface (red connotes losses)? And make sure you get in front of investors, but realize that you’re probably going to be judged if you’re out and about at conferences and events too often (who’s minding the portfolio?). Follow up but don’t be pushy, oh and, by the way that fine line may vary from investor to investor. Don’t let an investor read bad news in the press. And so on. And so forth.

Most of us that have been in the industry for long enough have digested these kinds of particulars and therefore navigate the industry fairly seamlessly. But I still often see one great divide between investors and managers when it comes to the accepted rules of play, and it has to do with the starting line.

Many investors approach investing from a place of “no,” while many, if not all, fund managers, approach investors from a place of “why the hell not?”

A fund manager may think: Why wouldn’t an investor want to talk about my fund with me? Why wouldn’t an investor trust me with their capital? Why wouldn’t I deliver satisfactory results? Why wouldn’t this strategy make sense right now? Why wouldn’t an investor want to buy on a drawdown – buy low, sell high, right? Why wouldn’t an investor have liquid funds to allocate to me now? If I just keep up the conversation, I know they’ll eventually come around. I know there are a lot of funds out there, but this is just one more, right?

An investor may think: This is the 20th long-short equity (core fixed income, SMID-cap) fund that’s contacted us this month. That manager lost a lot of capital at a prior fund. That fund doesn’t have the right infrastructure. That fund is too small to safely absorb our investment. That fund has too little capacity for us to scale up appropriately. That manager has been underperforming of late – there’s headline risk and career risk, and what if it’s not a buying opportunity but a sign that the manager isn’t talented? That’s a strategy we’re not interested in/over-allocated to right now. We’re using mostly passive investments for that part of the portfolio. We don’t have liquidity to make new investments without redeeming from existing investments. I don’t know how many more times I can tell this fund no. There are thousands of funds out there, and this is just one more.

Even though it’s frustrating, even though the response you get may not be the one you think you deserve (or what you think you’d do in the other person’s shoes), even if you don’t like it, that’s just the reality of the investing world. And it’s really important to have a little empathy about the realities on the other side of the fence. It can save you time, energy and perhaps even a little time in the penalty box.

Do you give good monthly letter? Do investors and prospects read your periodic missives or do they end up screened into the junk mail folder? Read on for how to make your monthly commentary more effective (and more widely read)!

We've all been there.

Moving, shaking, getting stuff done at an industry event.

Hitting up investors for contact details and meetings. Meeting fund managers who can potentially add value to an investment portfolio. Looking for new business prospects among investors and managers.

And then it happens. Knowingly or not, we commit one of the Seven Deadly Sins of Conference Attendance.

Duh duh DUUUUHHHH!

There is perhaps no better way to curtail your most earnest conference efforts than to commit one of the following breaches of event etiquette:

The First Deadly Sin: Chasing Investors Like It's A Zombie Apocalypse

(c) Resident Evil

We all know the shark-to-seal ratio at most investment industry events isn't exactly even. As a result, the investors in the room tend to get a lot of attention. You can see them at cocktail parties, during coffee breaks, or just walking across a room with a trail of hungry investment managers and investor relations folks in their wake. Once, at a GAIM conference in Monaco, they gave out actual proximity detectors to participants. It was like watching the movie Aliens, with investors playing the role of Ripley.

I know every manager that spends money on a conference is hoping to get maximum time with investors, but please, slow your zombie roll. Don't mob investors, and try to keep your interactions to a bare minimum to keep the flow going. You're not going to sell anyone on your fund over a granola bar in a hotel hallway. Keep it simple. Your name. "I'd like to introduce you to my very interesting fund when you have a moment - can I get your card?" Move On. And if an investor is obviously trying to get somewhere (to the coffee, to the can, to a meeting) give them a little breathing room. They'll actually think better of you for it.

The Second Deadly Sin: Hiding From Managers

(c) Mean Girls

Probably as a result of the first deadly sin, some investors have taken to disappearing during networking opportunities (breaks, cocktails and lunches), in the hopes of grabbing a little peace and quiet and piece of mind. As tempting as this may be, it can be beneficial to resist the desire to escape the maddening crowd. I'm assuming that investors go to conferences to find great investing opportunities. Eating lunch in a bathroom stall (ok, your hotel room) probably isn't the best way to find them.

The Third Deadly Sin: Cutting In Line

(c) Family Guy

A panel of investors has just finished up. You really want to talk to one (or more) of the presenters. A line of eager fund managers and conference participants has formed as the panel exits the podium. You wait patiently while they smile, shake hands and give cards to those in front of you. Then, out of nowhere, someone comes up, jumps the line and starts chatting up the investor. Worse yet, the next session starts and everyone has to move to retake their seats, leaving dreams of making contact with those investors unfulfilled. NOOOOOOO! So you. Yes you line-jumping fund manager (or marketer). Don't. The investor knows you did it (even if they can't always stop you). The managers who were patiently waiting know you did it (and are silently fuming). And you just look kind of like a tool. Just say no to line jumping.

The Fourth Deadly Sin: The Nameless Text

(c) Tropic Thunder

You managed to score an investor's card at a cocktail party, lunch or during a break. "What the hell," you think. "I'll send them a text to see if they have time to meet for breakfast or coffee in the morning." So you send a text: "Great meeting you last night. Grab a bite tomorrow am?" The only problem? The investor has NO FREAKING IDEA who you are. For all they know, this message could be a misdial from someone else's beer-goggled evening.

It's never a great idea to text investors anyway, unless you have an imminent meeting or they've given you express permission, but texting without identifying yourself and assuming that the investor will remember you out of throngs of fund managers is just silly. Include your name and the fund name. Or better yet, send an email.

The Fifth Deadly Sin: The Drive By

(c) The Dukes of Hazzard

Similar to the hiding from managers, the drive by occurs when investors, usually those scheduled to speak, attend an event only for their session. Fund managers, lured to pay event fees in part by the hugely cool and monied speaking faculty, get gypped out of their hard-earned dollars and investors get cheated out of finding good investment ideas for their portfolio. A true lose-lose.

The Sixth Deadly Sin: The Close Talker/Cornering Folks

(c) Seinfeld

Conferences are crowded. Conferences are loud. Investors are scarce. One-on-one time is at a premium. That's still no excuse from getting all up in someone's personal space. I have literally been backed into a corner at an event before and, let me tell you, I was not amused. I also once attended a conference after just getting Invisalign. I wasn't entirely used to the Invisalign trays yet, and had just hurriedly scarfed a mint when I was corralled by a fund marketer. Before I knew it, the mint flew out of my mouth and landed on the marketer's arm. I tried to be cool - I picked the mint off of him, said "um, I think this may be mine," and slunk off. But seriously, if you're so close that an Arthur Bell promotional mini-mint with lisp velocity and zero aerodynamics can hit you with enough force to stick to your skin, you are too damn close. An arm's length for distance is a good rule of thumb here.

The Seventh Deadly Sin: No Business Cards

(c) American Psycho

This one can be a bit tricky as both investors and fund managers are at times guilty. Generally speaking, investors eschew business cards to avoid a post-conference email zombie apocalypse, while fund managers and marketers either don't bring them to (Machiavellian interpretation) force investors into giving their cards up, or because (poor planning interpretation) they underestimate how many cards they will need.

Dear All: Conferences are networking events at heart. Bring cards and enough of them. That is all.

So there you have it.

Before you hit up your next Hedge Fund, Private Equity, Venture Capital, Institutional Investor or other industry event, make sure you are up-to-date on conference etiquette, or risk being judged in attendee purgatory.

Music is an important part of my daily life. Whether I’m ignoring other passengers on a plane whilst rocking out under my favorite Beats by Dr. Dre headphones, dancing out a bad day in my kitchen, or scaring little kids at the ice skating rink with my early morning musical selections, the music I listen to is a great indicator of my mood and a reasonable barometer for my life at any given time.

In fact, many of my regular readers have noted that there is almost always a song lyric hidden somewhere in my blog postings, and I have even occasionally been challenged to work in specific lyrics - a challenge that is almost always accepted, by the way.

It’s perhaps no surprise then that as I was winging home from yet another conference on Friday afternoon, I began to think about my various fund manager and investor conversations over the prior two days and decided that maybe what the investment industry really needs is a playlist.

That’s right, we all need a break from chasing capital, being chased for capital, due diligence, the low return environment, watch lists and pitch books, so why not get down and get funky?

So without further ado, here are reasonably comprehensive musical stylings for nearly every fund manager and investor mood. The song list and use cases are below, and I’ve even created a Spotifly playlist for those of you who want to break out your best Carlton Banks dance moves.

“Money” - The Flying Lizards – For both investors and fund managers, because isn’t that what this business is all about?

“I Need A Dollar” – Aloe Blacc – For pre-launch fund managers in search of their initial funds.

“Please, Please, Please, Let Me Get What I Want” – The Jealous Girlfriends – For any fund manager about to go into yet another meeting after a string of ‘maybe in 6 months, in 1 year, when you get to XX dollars.’

“Uprising” – Muse – Been blocked out of an opportunity by a gatekeeper or a bigger fund? This song will build your motivation to overcome them and succeed.

“Price Tag” – Jessie J – Been blocked out of an opportunity by a gatekeeper or a bigger fund? This song may help you keep that loss in perspective and your blood pressure in check.

“Patience” – Guns-N-Roses – Investors should have this playing in the background as fund managers wait in the conference room…

“How Soon Is Now” – The Smiths – …while fund managers who are on their third, fourth or fifth meeting in months hum this under their breath.

“What Have You Done For Me Lately” – Sharon Jones & The Dap Kings – Question that should be asked by every investor to their long-time funds.

“Shake It Off” – Us The Duo – Get a bad due diligence rating from a consultant? Fix the problems and shake it off.

“Every Breath You Take” – The Police – How every investor I know feels at the end of a conference.

“Just Got Paid” - *NSYNC – You got an allocation! Woot!

“Mo Money, Mo Problems” - The Notorious B.I.G. – Sure it’s great to gather more assets under management, but as you do, you’ll have to spend more time thinking about your business, operations, compliance, staffing, etc. And it may be harder to generate returns. Being bigger isn’t always glamorous. (Explicit Lyrics)

“Money For Nothing” – Dire Straights – What anyone outside of the investment industry probably thinks about your job.

“Billionaire” - Travie McCoy & Bruno Mars – The morning prayer of every emerging fund manager. (Explicit Lyrics)

“Did I Shave My Legs For This” – Deena Carter - For any investor who’s walked out of a meeting with a fund manager that was ridiculously off the mark based on size, performance, fund age, experience, drawdowns, strategy, etc. That was an hour of your life you’ll never get back.

“Fighter” – Christina Aguilera – When an investment you thought was great, isn’t.

“I’m Still Standing” – Elton John – When you are coming back from a drawdown.

“Everybody Knows” – Concrete Blonde – When you’ve been trying to gather assets for months and keep seeing bigger funds get bigger, even if your performance is better. This one may require a stiff drink.

“Somebody’s Watchin’ Me” – Rockwell – Oh the joy of being on an investor’s or consultant’s watch list.

“Extraordinary” – Liz Phair – You know that if investors ever got to know you, they’d want to give you money!

“Holding Out For A Hero” – Bonnie Tyler – Investors see hundreds of funds a year – this should be playing as they walk down the hall into yet another meeting.

“We Are The Champions” – Queen – When you get your first institutional allocation.

"Don't You Want Me" - Human League - When an investor or gatekeeper won't take your calls or schedule a meeting with you. ('You know I can't believe it when I hear that you won't see me...')

“Have You Met Miss Jones” – Tony Bennett – When you read my blog postings.

Got suggestions for songs I didn’t include? Sound off in the comments below. And happy listening!

I love this time of year. The airport delays. The wonky weather. The smell of burning dust in the heating vents. Snow panic that empties grocery store shelves of white bread and whole milk, even if the temperature is stubbornly in the 40s.

Oh, and the look of shiny hope on the faces of fund managers everywhere.

Ahhhh.....

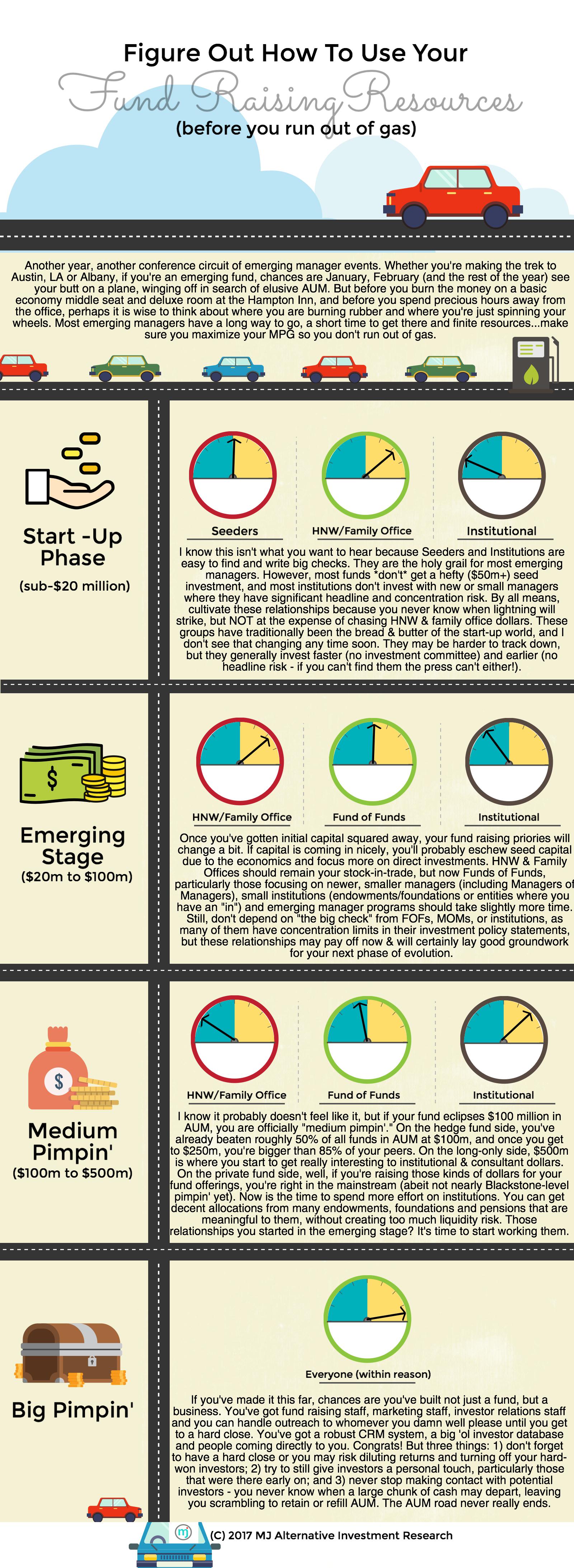

But before conference season road trips get too far underway, it's probably a good idea to think about where managers are spending their (finite) fund raising resources and where they could ease up on the gas.

(c) MJ Alts

As we commence another year of the great capital raising dance, I thought it would be fun to channel all of the back and forth, yes and no, hide and seek frustration into a little game. One that harkens back to a happier and simpler time, and one that anyone who has ever been under 12 or over 60 is familiar with.

So yes, ladies and gentlemen, this year we're gonna play a little Capital Raising BINGO. Simply print out the appropriate investor or fund manager card below and mark off (and date) each time you get a designated response.

The first investor who gets a BINGO can draft me as a single-use meat shield at an event.

The first fund manager who gets a BINGO will also get a prize, custom tailored to the fund in question.

Happy capital hunting! And may the BINGO odds be ever in your favor!

(c) 2017 MJ Alts

(C) 2017 MJ Alts