Me and my Granny, Christmas morning circa 1973/1974-ish

Well, 2016 has been one helluva year. Between the celebrity deaths (Bowie, Rickman, Prince in particular), fake news, election chaos, Zika, creepy clowns, Aleppo, and a host of other miserable events, I know I won’t look back on 2016 with anything remotely regarding fondness. In fact, I may pretend this year didn’t even happen, therefore reducing any future therapy bills and bolstering lies about my real age.

But alas, as much as I wish I could be Queen of de-Nile, I’m afraid 2016 did happen, and I have the blogs to prove it.

So if you need a good year-end chuckle to survive the holidays, the Electoral College vote, or your boozy office fete, or if you’re just craving random info and snarky rants about the investment industry, I’ve got just what the doctor ordered.

Here’s a complete wrap up of all my blog postings, by topic, for 2016. Enjoy them while you rock around the Christmas tree, drink your Gin and Tonica, or however you plan to celebrate the season.

See y’all next year!

Hedge Funds (Don’t) Suck

http://www.aboutmjones.com/mjblog/2016/11/1/killer-kittens-the-decline-of-hedge-fund-returns (Why you’re more likely to be injured by your toilet than get busted by the SEC)

http://www.aboutmjones.com/mjblog/2016/9/6/you-cant-handle-this-hedge-fund-truth (Perception versus reality in the world of hedge funds, told with pictures)

http://www.aboutmjones.com/mjblog/2016/5/17/hedge-fund-truth-dont-believe-everything-you-read (Animated blog about hedge fund fees, returns and the so-called talent shortage)

http://www.aboutmjones.com/mjblog/2016/2/29/the-hedge-fund-headline-predictorator (Using hedge fund headlines (13-Fs, Rich List, etc.) to tell time and seasons)

http://www.aboutmjones.com/mjblog/2016/2/22/person-or-people (Why we tar the investment industry with a big brush, and how that can hurt performance in the long run)

http://www.aboutmjones.com/mjblog/2016/9/20/can-this-hedge-fund-relationship-be-saved (The hedge funds people fell in love with 2000 to 2002…well, they’ve changed…)

Behavioral Finance

http://www.aboutmjones.com/mjblog/2016/8/16/thank-god-what-you-see-isnt-all-there-is (The bias of “what you see is all there is” and why that makes us think returns are lower than they are)

http://www.aboutmjones.com/mjblog/2016/7/19/great-expectations (Matching investor expectations to reality. Matching money manager expectations to reality)

http://www.aboutmjones.com/mjblog/2016/8/2/a-picture-is-almost-worth-1000-words (Truly terrible drawings that illustrate the “streetlight effect” and how we end up looking in the wrong place for strong performance)

Diversity And Investing

http://www.aboutmjones.com/mjblog/2016/11/15/lenny-bruce-is-not-afraid (A post election blog that covers the importance of diversity, ESG, thinking before you talk to investors and a long-term investment strategy)

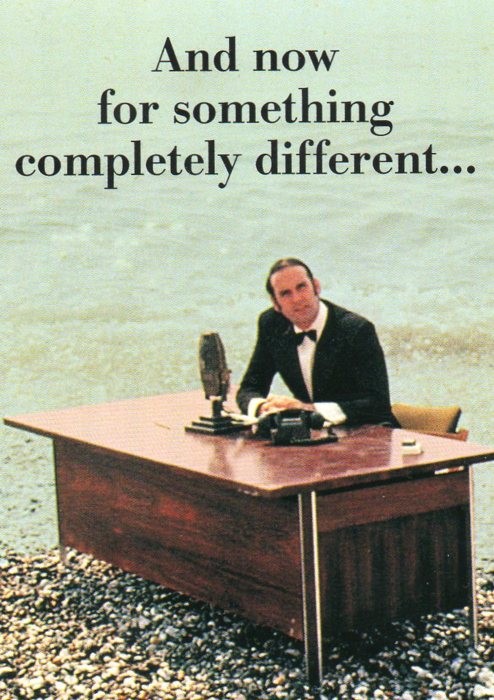

http://www.aboutmjones.com/mjblog/2016/7/5/and-now-for-something-completely-different (How cognitive, behavioral, structural and network diversity can benefit investors in hedge funds, private equity and venture capital)

http://www.aboutmjones.com/mjblog/2016/6/7/the-five-ps-of-gender-parity (Solutions for getting more women into the investment industry)

http://www.aboutmjones.com/mjblog/2016/1/25/no-quick-fix (The many unconscious biases men AND women have to overcome to achieve gender parity in investing)

http://www.aboutmjones.com/mjblog/2016/1/4/nostradamnus (Why the low return environment heading into 2016 may require some creativity on the part of investors re: active management, diversity, and emerging managers)

Emerging Managers and/or Capital Raising

http://www.aboutmjones.com/mjblog/2016/12/6/the-five-stages-of-emerging-manager-grief (Denial, anger, bargaining, depression and acceptance all figure into your capital raising experience)

http://www.aboutmjones.com/mjblog/2016/10/4/seed-me-seymour (The truth and consequences of seed capital)

http://www.aboutmjones.com/mjblog/2016/7/5/and-now-for-something-completely-different (How cognitive, behavioral, structural and network diversity can benefit investors in hedge funds, private equity and venture capital)

http://www.aboutmjones.com/mjblog/2016/6/21/capital-raising-crimes-punishment (Don’t be guilty of these capital raising crimes or pay the price of low AUM).

http://www.aboutmjones.com/mjblog/2016/4/5/are-you-hot-or-not (Evaluating a new fund launch – what makes some sizzle and others fizzle?)

http://www.aboutmjones.com/mjblog/2016/2/14/at-your-service (Choosing your service providers)

http://www.aboutmjones.com/mjblog/2016/1/31/making-the-first-move (How to make and keep contact with investors without making them hate you)

http://www.aboutmjones.com/mjblog/2016/1/4/nostradamnus (Why the low return environment heading into 2016 may require some creativity on the part of investors re: active management, diversity, and emerging managers)

Random Musings

http://www.aboutmjones.com/mjblog/2016/11/15/lenny-bruce-is-not-afraid (A post election blog that covers the importance of diversity, ESG, thinking before you talk to investors and a long-term investment strategy)

http://www.aboutmjones.com/mjblog/2016/1/18/money-manager-advice-dont-panic-but-do-bring-a-towel (What 2016 may bring - fee pressure, market volatility, few changes to the regulatory regime until after the election)

http://www.aboutmjones.com/mjblog/2016/5/3/kicking-the-buckets (Do strategy and style buckets help or hurt us? Getting past a checkbox mentality)

http://www.aboutmjones.com/mjblog/2016/4/18/you-are-so-money (Money manager horoscopes - don’t ask!)

http://www.aboutmjones.com/mjblog/2016/3/14/money-manager-report (How to effectively evaluate money manager performance without getting caught up in your benchmark underpants.

http://www.aboutmjones.com/mjblog/2016/10/18/sleepless-in-nashville (The things about the investment industry - hedge funds, private equity, venture capital, real estate, investment advisors, etc. - that keep me up at night)

http://www.aboutmjones.com/mjblog/2016/1/4/nostradamnus (Why the low return environment heading into 2016 may require some creativity on the part of investors re: active management, diversity, and emerging managers)

ESG/Socially Responsible Investing

http://www.aboutmjones.com/mjblog/2016/11/15/lenny-bruce-is-not-afraid (A post election blog that covers the importance of diversity, ESG, thinking before you talk to investors and a long-term investment strategy)

http://www.aboutmjones.com/mjblog/2016/2/7/ucee2gr6omdig0e5vtpsbx8qra738m (Predicting more interest in socially responsible/ESG investing, different pathways to fund management jobs, and a break from paper and PDFs)