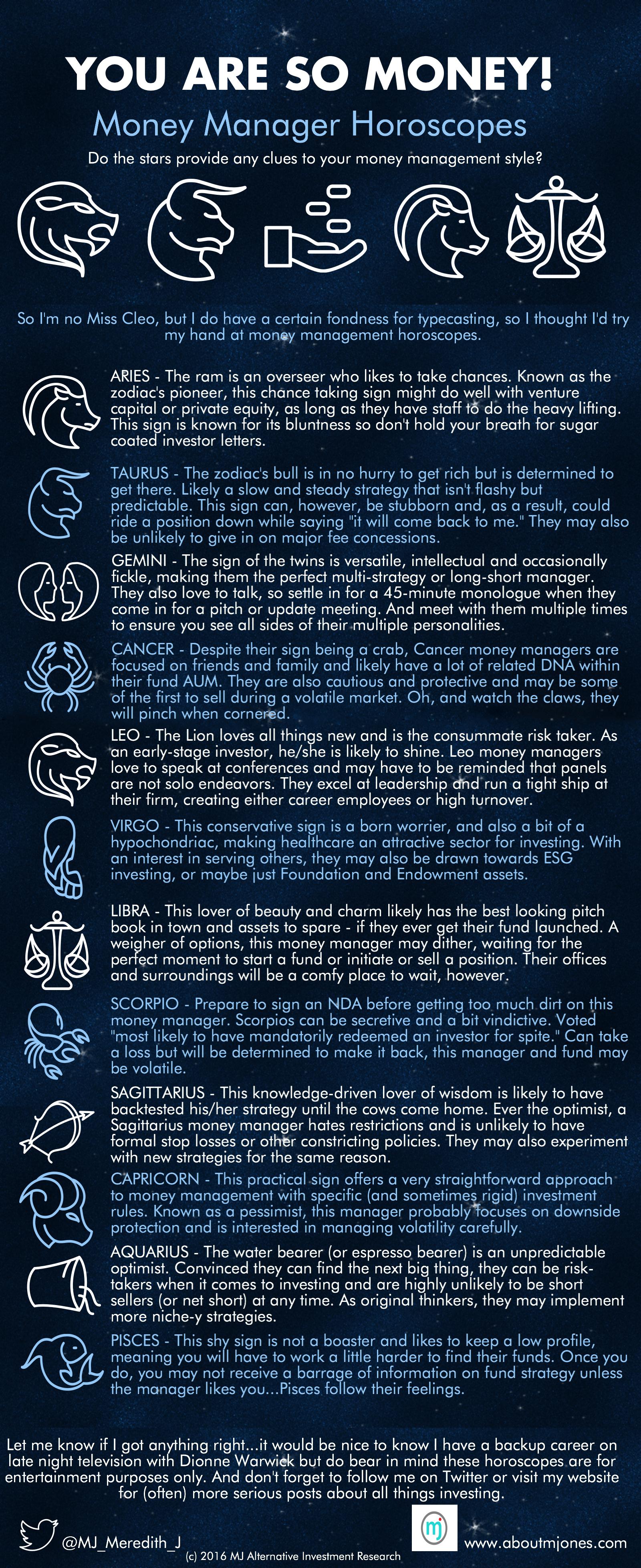

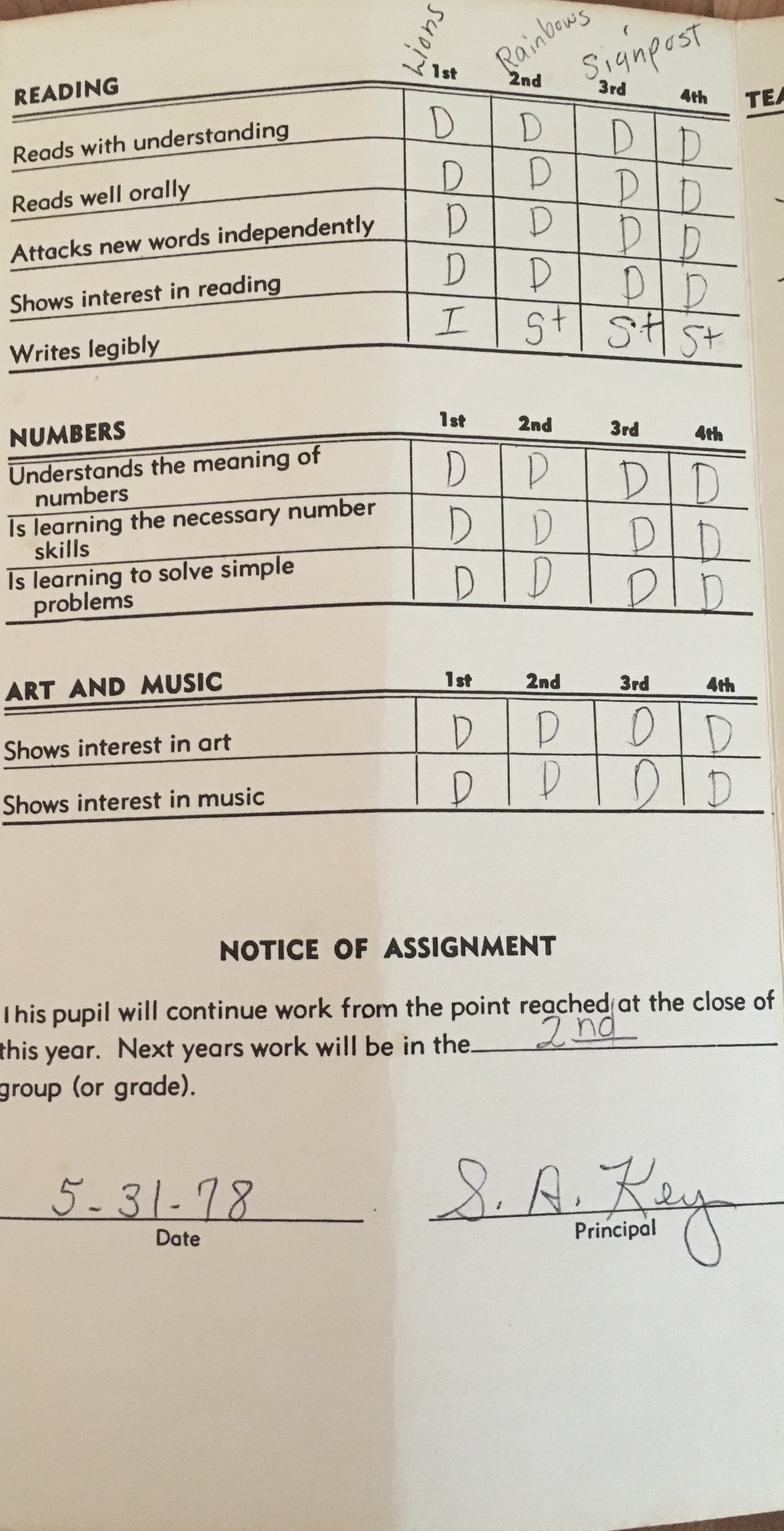

It’s that time of year again. The leaves are turning pretty colors. Kids are back in school. There is a real possibility of leaving my air-conditioned Nashville home without my glasses fogging upon hitting the practically solid wall of outdoor heat and humidity. And like any good Libra lass, I’m celebrating a birthday.

That’s right, it’s time for my annual orgy of champagne, mid-life crisis, chocolate frosting and introspection. Oh, and it’s time to check the batteries on the smoke detectors – best to make sure those suckers are good and dead before I light this many candles.

One of the things I’ve noticed in particular about this year’s “I’m old AF-palooza” is how much time I spend thinking about sleep. On any given day (and night), I’m likely to be contemplating the following questions:

- Why can’t I fall asleep?

- Why the hell am I awake at this hour?

- How much longer can I sleep before my alarm goes off?

- Why did I resist all those naps as a kid?

I even bought a nifty little device to track and rate my sleep (oh, the joy’s of being quantitatively oriented!). Every night, this glowy orb tracks how long I sleep, when I wake, how long I spend in deep sleep, air quality in my bedroom, humidity levels (in the South – HA!), noise and movement.

To sleep, no chance to dream

Yes, I’ve learned a lot about my nocturnal habits from my sleep tracker – for example, I move around 17% less than the average user of the sleep tracking system, I’m guessing due to having two giant Siamese cats pinning me down - but the one thing I didn’t need it to tell me was that I SUCK at sleep.

I’m not sure when I went from “I can sleep 12 hours straight and easily snooze through lunch” to “If I fall asleep RIGHT NOW I can still sleep 3 hours before my flight….RIGHT NOW and I can still get 2.75 hours…1.5 hours….” but it definitely happened.

I don’t drink caffeine. I exercise. I bought a new age aromatherapy diffuser and something helpfully called “Serenity Now” to put into it. I got an air purifier, a new mattress and great sheets.

But no matter what I try, I am a terrible sleeper.

I’ve concluded that it must have something to do with stress. I do spend an inordinate amount of time thinking about life, the universe and everything, so perhaps that’s my problem.

So in honor of my 46th year on the planet, I decided to compile a list of the top 46-investment related things I worry about at night. They do say admitting the problem is the first step in solving it, after all.

In no particular order:

- $2 trillion increase in index-tracking US based funds, which leads me to…

- All beta-driven portfolios

- Short-term investment memory loss (we DID just have a 10 year index loss and it only ended in 2009…)

- “Smart” beta

- Mo’ Robo – the proliferation (and the dispersion of results) of robo-advisors

- Standard deviation as a measure of risk

- Mandatory compliance training - don’t I know not to take money from Iran and North Korea by now?

- Spurious correlations and/or bad data

- Whether my mom’s pension will remain solvent or whether I have a new roommate in my future

- Politicizing investment decisions

- Did I really just Tweet, Blog or say that at a conference?

- Focusing on fees and not value

- Robo-advisors + self-driving cars equals Skynet?

- Going through compliance courses too quickly & having to do them over again

- Short-term investment focus

- Will I ever have to wait in line for the women’s bathroom at an investment event? Ever?

- Average performance as a proxy for actual performance versus an understanding of opportunity and dispersion of returns

- The slow starvation of emerging managers

- Is my industry really as evil/greedy/stupid as it’s portrayed

- Factor based investing – I’m reasonably smart – why don’t I get this?

- Dwindling supply of short-sellers

- Government regulatory requirements, institutional investment requirements and the barriers to new fund formation

- “Chex Offenders” – financial advisors and investment managers who rip off old people (and, weirdly, athletes)

- The vegetarian option at conference luncheons – WHAT IS THAT THING?

- Seriously, does anyone actually read a 57-page RFP?

- Boxes...check, style, due diligence...

- Tell me again about how hedge fund fees are 2 & 20…

- The markets on November 9th

- The oak-y aftertaste of conference cocktail party bad chardonnay

- Drawdowns – long ones mostly, but unexpected ones, too

- Dry powder and oversubscribed funds

- Getting everyone on the same page when it comes to ESG investing or, hell, even just the definition

- Forward looking private equity returns (see also: Will my mom’s pension remain solvent)

- Will my investment savvy and sarcasm one day be replaced by a robot (see also: Mo’ Robo)

- After the election, will my future investment jobs be determined by my membership in a post-apocalyptic faction chosen by my blood type?

- How many calories are in accountant-provided, conference giveaway tinned mints? (See also: conference chardonnay)

- Why are financial advisors who focus on asset gathering more successful than ones that focus on investment management? #Assbackward

- Dunning Krueger, the Endowment Effect and a whole host of ways we screw ourselves in investment decision making

- Why divestment is almost always a bad idea

- Active investment managers – bless their hearts – they probably aren’t sleeping any better than I am right now

- Clone, enhanced index and replication funds – why can’t we just K.I.S.S.

- The use of PowerPoint should be outlawed in investment presentations. Like seriously, against the actual law - a taser-able offense.

- Will emerging markets ever emerge?

- Investment industry diversity – why is it taking so looonnnnggg?

- Real estate bubbles – e.g. - what happens to Nashville’s market when our hipness wears off? And is there a finite supply of skinny-jean wearing microbrew aficionados who want to open artisan mayonnaise stores that could slow demand? Note to self, ask someone in Brooklyn….

- Did anyone even notice that hedge funds have posted gains for seven straight months?

Yep, looking at this list it’s little wonder that sleep eludes me. If anyone can help alleviate my “invest-istential” angst, I’m all ears. In the meantime, feel free to suggest essential oils, soothing teas and other avenues for getting some shuteye.

Sources and Bonus Reading:

Asset flows to ETFs: https://www.ft.com/content/de606d3e-897b-11e6-8cb7-e7ada1d123b1

Recent HF Performance (buried) http://www.valuewalk.com/2016/10/hedge-fund-assets-flows/

HF Replication: http://abovethelaw.com/2016/10/low-cost-hedge-fund-replication-may-threaten-securities-lawyers/

Average HF Fees: http://www.opalesque.com/661691/Global_hedge_funds_slicing_fees_to_draw_investors169.html

Political Agendas & Investing: http://www.njspotlight.com/stories/16/10/03/murphy-adds-plank-to-platform-no-hedge-funds-in-pension-and-benefits-system/

Asset Gathering vs. Investment Mgmt: http://wealthmanagement.com/blog/client-focused-fas-more-profitable-investment-managers

World's Largest PE Fund: http://fortune.com/2016/10/15/private-equity-worlds-largest-softbank/

Spurious Correlations: http://www.bloomberg.com/news/articles/2016-10-14/hedge-fund-woes-after-u-s-crackdown-don-t-surprise-sec-s-chair

Short-Term Thinking - 5 Months Does Not Track Record Make: http://www.cnbc.com/2016/10/14/venture-capitalist-chamath-palihapitiyas-hedge-fund-is-outperforming-market.html