I know I'm a little late. Perhaps you're still nursing a love hangover from last week, but just in case you still feel like spreading a little tenderness and affection throughout the fund management industry, I've created some handy dandy cut out cards to help you express your feelings. Because nothing says "show me the money" like some old school, cut out cards with your name scribbled on the back, right? So share the love y'all!

A new holiday fad for fund managers of all ages and denominations! LP On A Shelf (or ELP on a Shelf, as I call him) knows when you've been spending too much time at conferences, when you're creating pitch books that are too long, or when you're not hiring critical personnel (or skill sets) and will tell Santa not to offer you an allocation in the New Year.

I’d like to think I’m not big into snap judgements, but a recent trip to the left coast in super-glamorous coach showed me that I’m completely full of it on that front. As I sat in my window seat waiting for my fellow fliers to board, I quickly sized up each and every passenger as they came down the aisle to determine whether they were someone I wanted to share air (and an armrest) with for the next four hours.

I mentally begged for the tiny old ladies. Anyone the size of a professional athlete (save maybe a jockey) I tried to psychically hurry past my row. I mean, seriously, those coach seats aren’t wide enough for a five-foot three figure skater, let alone a member of the NFL.

In fact, I still sometimes have flashbacks to a flight a couple years back when I was marooned next to a professional bowler for five hours. He was completely lovely, for what it’s worth. He even offered me a piece of gum mid-flight. Sadly, when he pulled said gum out of his pocket, it had liquified. I guess the heat that had built up to Dante’s Inferno level between our inexorably connected hips was just too much for a pack of Juicy Fruit to take.

Yeah, just thinking about that again kind of made me throw up in my own mouth.

Anyway, after the tall but sinewy gentleman took the middle seat on my recent flight, I had plenty of time to think about investment industry stereotypes as I tried not make arm or thigh contact midflight. And since I’m often picking on managers in this blog, I decided to fixate on investors for once.

So here you go!

It’s a completely unscientific, grossly generalized profile of the five investors most money managers meet.

The Tomato Seed– As a Southern girl, I know a thing or two about tomatoes. I know that any tomato eaten before the month of July (or after the month of September) is likely to taste like a whole lot of nothing. I know that, after a certain age, I’ll be required to grow tomatoes if I want to continue living in the South. And I know that tomato seeds are slippery little buggers. Seriously, try cutting a good beefsteak tomato on a cutting board. Now try to pick up one seed on your finger. I bet it squished away from you, didn’t it? Tomato Seed Investors are the exact same way. You can try to pin them down on something (a phone call, a visit to their offices, a due diligence trip, a date for subscription docs to arrive) and you just can’t quite to get them to stick. Tomato Seeds may employ a variety of tactics to slide away… “I’m sorry I didn’t see your email.” “I’m in another city that day, try again next trip.” “Contact my assistant (she’s out for maternity leave)…” but the result is always the same.

The T-Rex- You’ve seen a T-Rex right? Not a real one, obviously, but a rendition or skeleton of one, I’m betting. You know how they have really short arms? Picture those arms trying to reach into their pockets to grab a wallet. There’s no freakin’ way, right? T-Rex Investors similarly have very short arms and very deep pockets. They may say all the right things about how great your strategy is or how they love your team and your energy. They may even go through the full due diligence dance before all is said and done. But they never actually hand you any money. T-Rex Investors are one of the trickiest to deal with in the wilds as you don’t actually know who they are until you’re at least two years in. Up until that point, you kind of have to keep being nice and going through the motions, but once you’ve met a T-Rex, you’ll always be a bit scarred by the experience and perhaps even prone to pushiness with future investors.

The Ghost– For anyone who has ever dated on Tinder, Bumble, Match or, hell, just dated period, The Ghost is a familiar figure. You meet The Ghost Investor at a conference or event. You have a great conversation. There’s terrific follow up. You have another meeting or talk shop over a lovely Merlot. And then The Ghost, well, ghosts. You send emails that fly into cyberspace, never to been seen or heard of again. You leave messages on every available phone the investor has but get no return call. You contemplate hiring a medium to see if you can raise The Ghost Investor from the dead, all to no avail. The Ghost has disappeared, likely never to be seen in more than passing again. They may appear as a brief apparition at a conference but are usually viewed in passing (as they spirit away from all the managers they’ve ghosted before) or from a distance.

The Doorknob– One of my ex-boyfriends was a doctor. He liked to tell me how his day was over dinner and more than a few gin and tonics. Some of the stories were sad, some had delightfully happy endings, and some were SSDD. The most common refrain was complaints about patients who waited until Doctor Dude’s hand was literally on the doorknob, walking out of the exam room, to tell him that something else was wrong. It could be small, like an ingrown toenail, or utterly ridiculous in a “Hey-doc-did-I-tell-you-I-faint-every-time-I-walk-up-the-stairs?” kind of way. Whatever it was, it always stopped Doctor Dude cold. He’d thought he’d reached escape velocity and then WHAMMO! There are investors who excel at The Doorknob, too. You jump through every hoop and are told, explicitly or implicitly, that a wire is imminent. Then, The Doorknob strikes. “Oh, hey…we were just wondering about the trader you fired three years ago…can you provide his contact details to us?” “Gee, we’re really close but we are actually going to need to chat with your compliance person again to get her perspective on your ERISA AUM.” “So, it’s probably nothing, but in our background check we discovered that your chief information officer has a criminal record and we’re gonna need to clear that up.” Whatever it is, it hits you in the face like a glass of ice water and it has to be dealt with before you get any moola. Makes you want a gin and tonic too, right?

The WOW– The WOW Investor (Walk On Water) is the rarest of all investors. They return calls and emails within a reasonable amount of time. Their due diligence process, however lengthy, goes exactly according to plan. They clear up issues quickly and efficiently. They understand that, in order to run a successful business, you actually need cashflow to pay talent and build infrastructure AND they don’t begrudge you making a little coin, too. They call when they have questions and potentially provide insight into how best to communicate with other investors. The WOW investor is the Holy Grail of Limited Partners. They can be confused with the T-Rex and the Ghost, at least for a period of time, but will distinguish themselves in relatively short order by, oh, writing a check or returning a call. If you are lucky enough to find a WOW Investor, you should do everything in your power to keep them happy, up to and potentially including offering them your first-born child. Your wife or husband may grumble, but then again, they’ve never had to deal with the less desirable types of investors.

As you go about your capital raising business, be on the lookout for each of these types of investors. You may not be able to ID them as quickly as I could a potential seatmate on my flight, but you’ll get better at it over time.

(c) 2009 DreamWorks "Up In The Air"

Last week, I almost peed in my hotel room closet.

Yeah, you read that right.

It was the middle of the night. I’d been in different hotels (interspersed with brief sojourns at home) for part of every week since the beginning of the year. And for one brief and almost disastrous moment, I simply forgot where I was. Luckily, I came to my sleep-addled senses when I tripped over one of my own shoes, placed strategically outside the closet door. But still, it was a sobering moment.

Many of us that work in the asset management industry spend a tremendous portion of our lives on the road. Money managers must travel to drum up investments, to keep current investors happy and informed, present at investment committee meetings and otherwise support their assets under management. Investors trek for diligence visits, periodic onsites, and other gatherings (trustee meetings/retreats, investment committees, etc.). And of course, there’s the ever-expanding conference circuit to keep both groups, plus a hoard of service providers, racking up craploads of frequent flyer miles. Many of which we’ll never use because we’re pretty darn happy when we actually get to spend an extended period of time at home.

Over the past ten+ years of extensive travel, I’ve developed a few coping mechanisms to manage the rigors of being almost constantly on the go. And after sharing my closet story with a few folks last week who seemed to identify with my temporary travel amnesia a little too much, I came to realize that we could all use a few hacks to make it through 2018 as productively, and sanitarily, as possible.

So here goes: Meredith’s Top Five Travel Hacks for the Investment Industry

1) File business cards in your conference name badges. After a conference is complete, I always put the cards I’ve collected into the back of my used name badge. That way, I can remember where I met someone and/or pull contact information for a specific person or company quickly.

2) Carry a spare lanyard. If you work for, well, just about anyone, chances are you’ve at one point had a company-branded lanyard. Put it in your computer bag and take it on the road. That way, when you arrive at a lanyard-free conference, or, horror of horrors, at a conference where they expect you to use safety pins to secure your nametags, you’ll be able to spare your look and your clothes while still letting people know who you are. Don’t have a company-branded lanyard laying around? Choose a key service provider and proudly rock their lanyard.

3) Put one of your business cards in the back of your namebadge while at the conference. So, lanyards are great (see above) but sometimes (nearly all the time if you’re me) those contrary contraptions spend more time making your nametag face your belly button than the person you’re talking to. To ensure that folks can always tell who you are and who you’re with, put one of your own business cards in the back of your nametag while you’re at the event. Frontward or backward, you’ll be good to go.

4) Get a good business card with a white, non-slick back. Take out your business card right now and grab a pen. Not a good pen, but a crappy conference giveaway pen with a somewhat bajiggety rollerball. Write your name on the back of your card. Can you see it? Does it smear if you rub your thumb across it? Is there room to write your entire name? If you answered “no” to any of these questions, your business card is the bane of people’s existence. How do you expect us to write notes on the back of a card that doesn’t have ample real estate, is too dark, or where the ink rubs off on our clothes or hands? Make it easy for the people at an event to connect with you later with light colored cards on decent card stock.

5) Know how to sneak in breaks. If you’re a money manager at a conference, you’re there to network. That means anything that says “break” on it in the conference program is showtime for you and your fund. If you’re an investor, your breaks are a little more sacred…if you can get out of the event for a few minutes unmolested. In other words, if you want to get a few minutes to yourself in either case, you’re going to have to plan for it. Money managers, scope out the sessions in advance and figure out one or two you can skip. Note: Do not skip sessions with anyone who has an investment in your fund, who works for your fund, or who could invest in your fund. Investors, you may have to make a break for the break a couple of minutes before a session ends to get to a “safe zone” (bathroom, hotel room, Starbucks). Obviously, you shouldn’t avoid breaks altogether (the best way to find talent is to meet talent!), but skipping out on one out of four in a day may help your sanity level a bit.

Of course, there’s always more where those came from, such as:

- Don’t ever, ever touch your face during a conference or event…with all the hand shaking, that’s the single best way to get sick.

- When going to the airport or train station after a big event, don’t talk business on your phone or with friends until you know you’re not surrounded by conference goers that you don’t recognize because they are now attired in “real people clothes.”

- And of course, always put your shoes outside the closet door.

I’m sure you have a few tips and tricks of your own, so feel free to leave them in the comments below, but if you follow these simple guidelines, you’ll likely save yourself some headaches and may make even better use of your time on the road again.

Happy Traveling!

It seems as if everyone has been pretty focused on Tweets, hashtags, and the general dumbing down and coarsening of communication of late. So I thought this week I'd inject a little culture into my investment blog. What if investors and fund managers could only think or talk in Haiku? The sentiments would likely remain the same, but the delivery might be much more civilized. So here you go: investor and manager haikus. Feel free to add your own in the comments section.

Investor Haikus

Seasons change, my phone

Keeps ringing. The same number

Calls. Persistent funds.

Not the best idea

To use diligence checklist

On the kids’ playdates.

Must I disclose this

Doughnut to compliance or

Can I eat it all?

Can’t wait to discuss

Fees with the trustees at our

Next board meeting. Yay.

I don’t want to shake

Hands while grabbing paper towels

In the bathroom. Gross.

Manager Haikus

Fall becomes Winter,

And I find myself stuck in

Endless diligence.

Performance is great!

This sector is hot! So why

Don’t people subscribe?

Do you want info

On my investment fund? No?

Maybe tomorrow?

Families, pensions,

High net worth peeps, endowments.

Lather, Rinse, repeat.

Competitive edge?

It’s our process and people!

Oh. You’ve heard that one.

(c) 1988 Bull Durham

Anyone who has spent any time talking to me or reading my blogs knows I love a good movie. Although I don’t see as many as I’d like these days, I love how a film can transport you, inspire you, create emotion and just generally entertain. I even use the love of a particular film as a kind of odd litmus test in friendship, business and dating situations. Did you adore Forrest Gump? Yeah, that makes me seriously question your judgment.

But some movies stand out more than others in the MJ Pantheon of Favorite Flicks. Star Wars (the original trilogy, natch), Shawshank Redemption, Argo, Bridesmaids, The Blind Side (don’t judge me), The Wolf of Wall Street, The Princess Bride, 50/50, Raiders of the Lost Ark, Rudy, Love Actually, Aliens, The Terminator (1 & 2), Die Hard and Pride & Prejudice (the 2005 version) are just a few of my all-time faves.

And of course, there’s Bull Durham. Though I’m not a huge fan of baseball (too slow, lots of spitting, often hot), I loved that movie when I first saw it at the ripe old age of 18. It was my first sophisticated on-screen romance, which had theretofore been populated by teen sex films (e.g. Porky’s), John Hughes offerings (Pretty in Pink, Sixteen Candles) and saccharine Disney scripts.

When Kevin Costner’s Crash Davis gave his epic speech during Annie Savoy’s, ahem “tryout” between Crash and Nuke LaLoosh (Tim Robbins), Susan Sarandon wasn’t the only one who sighed “Oh my…”

In case you haven’t seen Bull Durham since it’s original 1988 release (sacrilege!), here’s the scene in question. (And you may not remember this, but it is officially NSFW.)

Since we’re nearing the end of summer, I decided to watch my one and only cinematic homage to baseball over the long Labor Day weekend. It got me thinking about what I believe in when it comes to life and investing, and it wasn’t long before I was on an epic, Crash Davis-esque rant.

“I believe in manager skill. That checkbox due diligence only works if you also have a high EQ for evaluating people. That generalists and specialists should work together to combine the best aspects of myopia and a more holistic, 30,000-foot view. I believe that people who call themselves long-term investors, but who regularly redeem in less than 24 months, are full of crap. I believe that managers who say they can’t find diverse job candidates either exist in ridiculously insulated bubbles or have no imagination. I believe that having less than 10% of hedge funds, mutual funds, venture capital and private equity funds managed by women – who comprise 50% of the population – means we’re missing out on some amazing talent. I believe if all investment managers and all investors agreed to always interview a diverse candidate for jobs/fund searches, it would go a long way towards adding cognitive and behavioral diversity to the industry.

“I believe in downside deviation, maximum drawdowns and time to recovery. I think standard deviation is silly. I believe most investors don’t worry about upside volatility, but that out-of-character positive returns should trigger a monitoring phone call as fast as a losing month. I believe in macro funds, commodity trading advisors and short selling strategies, and that investors should consider these strategies before the proverbial shit hits the investing fan. I think hedging with index options isn’t real hedging, and that taking 8 to 12 months to complete due diligence is like wanting to get pregnant without risking actual sex.

“I think investment conferences should improve the quality of their cocktail party wine. That you should NEVER order the vegetarian option for lunch at an event unless you have a desire to eat something that looks like road kill. I believe in polite but persistent marketing. I think that if you focus on your expertise instead of a sale, you’ll amass greater assets under management (AUM). I believe you should always check time zones before calling a prospect or client, and that texting is NSFP (Not Suitable For Prospects).

“I believe in differentiated networks, niche strategies and cognitive alpha. I believe in gut feelings and spidey senses about people, markets, and investments. I believe in contrarians, and in sticking to your investment guns, as long as you periodically re-visit your thesis to ensure you’re not just stubborn. I believe going to cash takes testicular fortitude. I believe getting back into the market does, too. I believe in good business cards, firm handshakes and not approaching prospects in the bathroom.

“I believe that those funds that don’t get into responsible investing/ESG now will be licking AUM wounds in years to come. I believe that all investment managers make mistakes, and that admitting mistakes and ensuring that they don’t happen again is a mark in a manager’s favor. I believe in strategy continuity, but not necessarily in strategy drift. And that past performance isn’t indicative of future results, but it beats knowing nothing about how strategy translates into returns.

"I believe that most meetings could be emails, and those that cannot should be limited to one hour, tops. Oh, and any meeting that goes longer than one hour should involve snacks.

"Finally, I believe in small funds. New funds. Large funds. Old funds. Women run funds. Minority run funds. White guy run funds. Bread and butter funds. Niche funds. Liquid funds. Illiquid funds. And contrarian funds. I believe there is manager talent and fund utility in all types of funds, and that only by looking at the full menu can investor's hope to have a balanced portfolio meal."

Oh my!

So get back to work all. I hope you enjoyed my little investment rant…pith in the wind if you will. Maybe it will get you thinking about YOUR investment beliefs as we ramp back up into what I think could be a certifiably crazy fall market. Oh, and if you have an investment belief or rant of your own (or a good movie suggestions), feel free to sound off in the comments below.

If there's anything that several decades of mis-singing song lyrics has taught me, it's that you can't be sure that what you say is what people hear. And fund managers and investors are not immune to this phenomenon any more than the Pandora-loving public. If you've used any of the phrases below, you might want to ensure that investors picked up what you were putting down and didn't walk away with their own interpretation of your lyrics.

Oh, and visit www.kissthisguy.com for a giggle over misheard lyrics before the day is over...you'll thank me for it.

(c) 2017 MJ Alts

(C) Andertoons

NOTE FROM MJ - OK, I know I said no more blogs that relate in any way to my dating life, but some comments on my last blog about performance reminded me of this not-so-quaint interlude. I am now officially out of dating mishaps, so read on about the importance of evaluating performance data and rest assured you won't have to read anything more about my love life for a long, long time.

Merriam-Webster defines a spinster as “an unmarried woman and especially one past the common age for marrying.” Tennessee women tend to get married at 26.1 years old, so given that I’m now into my 20th year in the investment industry and my middle name ain't Doogie Howser, I think it’s pretty safe to say I’m a spinster, and have been for some time.

From time to time, that fact has weighed on my mind, leading me to pursue any number of methods for exiting singlehood. But my best (read: worst) move had to be when I decided to offer my friends a bounty for fixing me up.

That’s right, I straight up bribed my friends to find me dates. I offered $100 bucks to any friend that set me up with a guy that I found appealing enough for a second date. Sure, it wasn’t a princely sum, but in Nashville $100 bucks goes a long way.

And the dates started rolling in. There was the guy who was afraid of shrimp. And a man who, for some reason, felt that racial slurs were polite conversation. There was this one gentleman whose hands were so diminutive that he unironically ate baby corn like Tom Hanks in “Big.”

After a string of truly horrible outings, I started to press one of my more prolific booty bounty hunters for more details before agreeing to meet another guy. Her response: “He’s single, you’re single. You’re both interesting. What else is there to know?”

I ended this particular incentive program shortly thereafter. It seems that many in my circle felt similarly – if a man met the most basic criteria (XY and breathing) and could be described in any way as “interesting” it was a match.

Weirdly enough, during a recent discussion on fund performance, I had a flashback to the days of my dating stimulus plan. It seems that there is a (growing?) school of thought in Investmentlandia that past performance doesn’t matter, that the qualitative always trumps the quantitative, and that an “interesting” strategy should be enough to generate investor demand. One person recently commented on another blog: “Performance is 90% meaningless anyway…” And, just this May, Morningstar reported investors yanked $99 billion from actively managed funds that beat their benchmarks over the 12-month period ending January 31, 2017. What the…?

Perhaps this attitude springs from relentless benchmarking and active management “performance shaming” in recent years. After all, no one envies a CIO when they tell their board that their endowment, foundation or pension portfolio underperformed the S&P 500, and no one wants to be the fund manager in that slide deck that didn’t deliver. But rather than broad-brush damning of performance data, perhaps it makes sense to put it in perspective.

By the time you’ve spent any time in the investment industry, you’ve had the following phrase beaten into your noggin: “Past performance is not necessarily indicative of future results.” And to be sure, that’s not an incorrect assessment. However, past performance is also not wholly insignificant either.

At the end of the day, an investment strategy can sound wonderfully interesting, but it also has to generate returns. Past performance is one of the few ways an investor can tell if a particular investment strategy has, at least at one time, worked. Maybe the strategy hasn’t seen a full market cycle, and certainly extremely short or limited track records can be statistically insignificant, but I believe most investors still want to know that an allocation has a chance of success prior to making an investment. I mean, it ain't the thought that counts when it comes to investing, it's the returns, right? Otherwise wouldn’t first time funds and seed capital opportunities be much more popular?

And while it’s true that investors can’t bank on return data alone, past performance can provide some significant quantitative clues into potential qualitative issues. See a fund that is way out of step with peers? Could be skill, could be deception. There’s a fund that avoided or mitigated drawdowns against his or her benchmark! What can you learn from those periods about how the fund manager approaches investing, markets and risk? Run across some ridiculously smooth returns? How is the fund manager marking the book and have they ever been called Bernie? Have you ever graphed performance versus assets under management for a fund and firm? That simple exercise can yield questions about capacity and organizational infrastructure.

Of course, these are all fund-level performance questions, but there are a host of allocation-level considerations as well. For example, Vanguard examined the performance of flexible allocation funds from January 1977 through December 2016 and found that in the three most recent bull market periods, between 30.96% and 36.33% of the active managers outperformed a 60/40 portfolio. In the two bear market periods, however, those percentages jumped to 45.50% and 65.70%. And oft-maligned hedge funds? They’ve been underperforming lately, but lost just 18% in 2008, compared with 34% for the DJIA and 38% for the S&P 500. If we don’t take that past performance into consideration, what effective asset allocation decisions can we make to position a portfolio for future volatility?

Look, I’m not saying the data is the only thing, but I am saying it is something. Given enough data points, I could have potentially avoided having dinner with a crustacean-phobe, “Squirrel Paws” and a member of the KKK. If that’s not a worthy goal, then consider the money my matchmaking friends left on the table by ignoring relevant data. And at the end of the day, no investor – either in my love life or institutional - should want to do that.

Sources:

https://www.merriam-webster.com/dictionary/spinster

https://www.dailydot.com/irl/average-age-marriage-by-state/

https://seekingalpha.com/article/4069668-bull-bear-markets-well-active-management-hold

http://www.cbsnews.com/news/hedge-funds-took-a-serious-hit-in-2008/

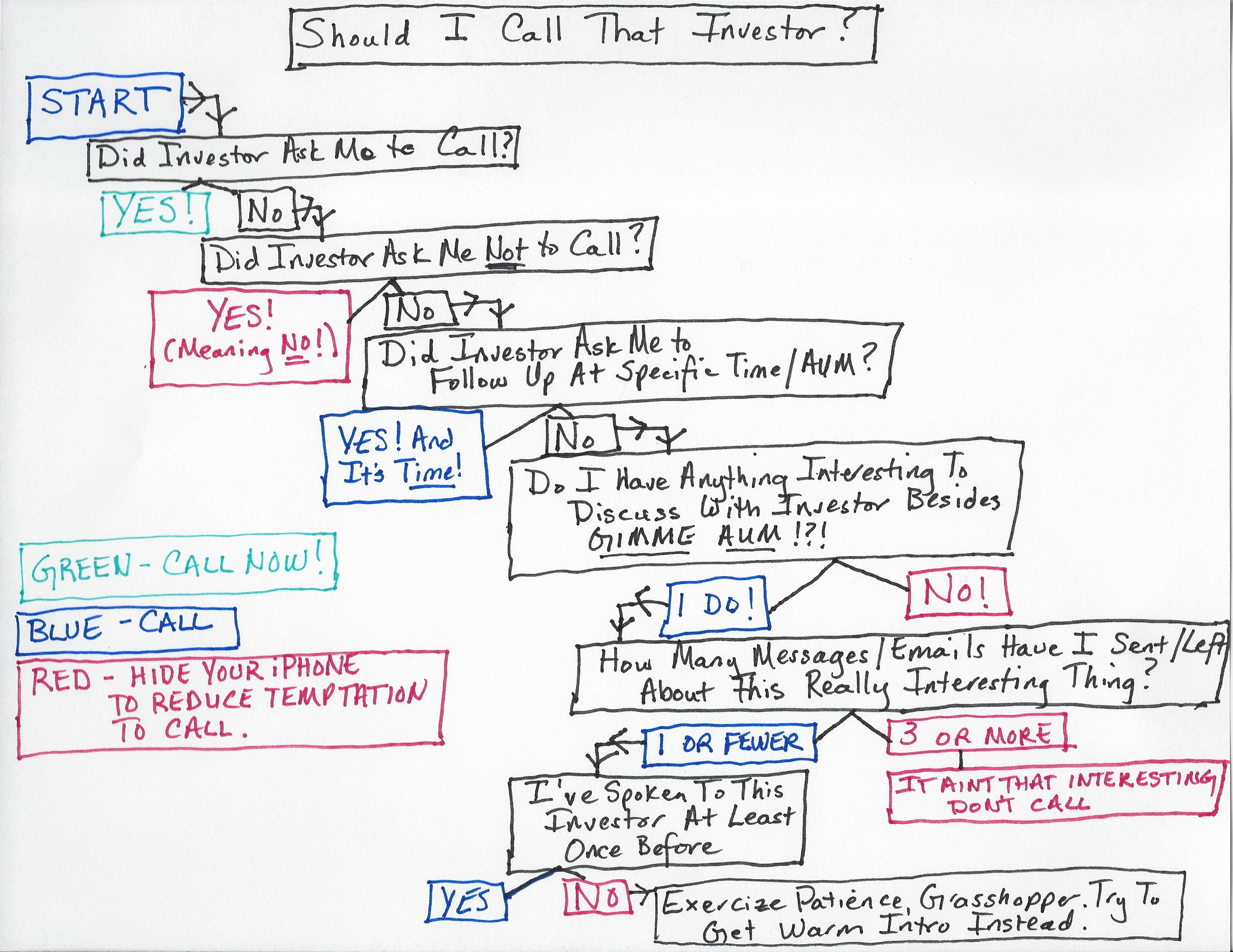

Dialing for dollars. It was all so much easier before Caller ID.

Now money managers have to wonder "Have I called too much?" and "Is now a good time to talk?" and "Is this investor ever going to pick up the damn phone?"

While investors fret "Will this fund manager ever stop calling me?" and "Sacramento...who do I know in Sacramento?" and "If I let it go to voice mail one more time, does that make me a bad person?"

To help investors and managers navigate the tricky capital raising call landscape, I've created the following decision trees to help fund managers know when it's ok to call, and when investors should (and shouldn't) pick up.

Happy smiling and dialing! And may the odds be ever in your favor!

(c) 2017 MJ Alternative Investment Research

(c) 2017 MJ Alternative Investment Research

Music is an important part of my daily life. Whether I’m ignoring other passengers on a plane whilst rocking out under my favorite Beats by Dr. Dre headphones, dancing out a bad day in my kitchen, or scaring little kids at the ice skating rink with my early morning musical selections, the music I listen to is a great indicator of my mood and a reasonable barometer for my life at any given time.

In fact, many of my regular readers have noted that there is almost always a song lyric hidden somewhere in my blog postings, and I have even occasionally been challenged to work in specific lyrics - a challenge that is almost always accepted, by the way.

It’s perhaps no surprise then that as I was winging home from yet another conference on Friday afternoon, I began to think about my various fund manager and investor conversations over the prior two days and decided that maybe what the investment industry really needs is a playlist.

That’s right, we all need a break from chasing capital, being chased for capital, due diligence, the low return environment, watch lists and pitch books, so why not get down and get funky?

So without further ado, here are reasonably comprehensive musical stylings for nearly every fund manager and investor mood. The song list and use cases are below, and I’ve even created a Spotifly playlist for those of you who want to break out your best Carlton Banks dance moves.

“Money” - The Flying Lizards – For both investors and fund managers, because isn’t that what this business is all about?

“I Need A Dollar” – Aloe Blacc – For pre-launch fund managers in search of their initial funds.

“Please, Please, Please, Let Me Get What I Want” – The Jealous Girlfriends – For any fund manager about to go into yet another meeting after a string of ‘maybe in 6 months, in 1 year, when you get to XX dollars.’

“Uprising” – Muse – Been blocked out of an opportunity by a gatekeeper or a bigger fund? This song will build your motivation to overcome them and succeed.

“Price Tag” – Jessie J – Been blocked out of an opportunity by a gatekeeper or a bigger fund? This song may help you keep that loss in perspective and your blood pressure in check.

“Patience” – Guns-N-Roses – Investors should have this playing in the background as fund managers wait in the conference room…

“How Soon Is Now” – The Smiths – …while fund managers who are on their third, fourth or fifth meeting in months hum this under their breath.

“What Have You Done For Me Lately” – Sharon Jones & The Dap Kings – Question that should be asked by every investor to their long-time funds.

“Shake It Off” – Us The Duo – Get a bad due diligence rating from a consultant? Fix the problems and shake it off.

“Every Breath You Take” – The Police – How every investor I know feels at the end of a conference.

“Just Got Paid” - *NSYNC – You got an allocation! Woot!

“Mo Money, Mo Problems” - The Notorious B.I.G. – Sure it’s great to gather more assets under management, but as you do, you’ll have to spend more time thinking about your business, operations, compliance, staffing, etc. And it may be harder to generate returns. Being bigger isn’t always glamorous. (Explicit Lyrics)

“Money For Nothing” – Dire Straights – What anyone outside of the investment industry probably thinks about your job.

“Billionaire” - Travie McCoy & Bruno Mars – The morning prayer of every emerging fund manager. (Explicit Lyrics)

“Did I Shave My Legs For This” – Deena Carter - For any investor who’s walked out of a meeting with a fund manager that was ridiculously off the mark based on size, performance, fund age, experience, drawdowns, strategy, etc. That was an hour of your life you’ll never get back.

“Fighter” – Christina Aguilera – When an investment you thought was great, isn’t.

“I’m Still Standing” – Elton John – When you are coming back from a drawdown.

“Everybody Knows” – Concrete Blonde – When you’ve been trying to gather assets for months and keep seeing bigger funds get bigger, even if your performance is better. This one may require a stiff drink.

“Somebody’s Watchin’ Me” – Rockwell – Oh the joy of being on an investor’s or consultant’s watch list.

“Extraordinary” – Liz Phair – You know that if investors ever got to know you, they’d want to give you money!

“Holding Out For A Hero” – Bonnie Tyler – Investors see hundreds of funds a year – this should be playing as they walk down the hall into yet another meeting.

“We Are The Champions” – Queen – When you get your first institutional allocation.

"Don't You Want Me" - Human League - When an investor or gatekeeper won't take your calls or schedule a meeting with you. ('You know I can't believe it when I hear that you won't see me...')

“Have You Met Miss Jones” – Tony Bennett – When you read my blog postings.

Got suggestions for songs I didn’t include? Sound off in the comments below. And happy listening!

It’s that time of year again. The leaves are turning pretty colors. Kids are back in school. There is a real possibility of leaving my air-conditioned Nashville home without my glasses fogging upon hitting the practically solid wall of outdoor heat and humidity. And like any good Libra lass, I’m celebrating a birthday.

That’s right, it’s time for my annual orgy of champagne, mid-life crisis, chocolate frosting and introspection. Oh, and it’s time to check the batteries on the smoke detectors – best to make sure those suckers are good and dead before I light this many candles.

One of the things I’ve noticed in particular about this year’s “I’m old AF-palooza” is how much time I spend thinking about sleep. On any given day (and night), I’m likely to be contemplating the following questions:

- Why can’t I fall asleep?

- Why the hell am I awake at this hour?

- How much longer can I sleep before my alarm goes off?

- Why did I resist all those naps as a kid?

I even bought a nifty little device to track and rate my sleep (oh, the joy’s of being quantitatively oriented!). Every night, this glowy orb tracks how long I sleep, when I wake, how long I spend in deep sleep, air quality in my bedroom, humidity levels (in the South – HA!), noise and movement.

To sleep, no chance to dream

Yes, I’ve learned a lot about my nocturnal habits from my sleep tracker – for example, I move around 17% less than the average user of the sleep tracking system, I’m guessing due to having two giant Siamese cats pinning me down - but the one thing I didn’t need it to tell me was that I SUCK at sleep.

I’m not sure when I went from “I can sleep 12 hours straight and easily snooze through lunch” to “If I fall asleep RIGHT NOW I can still sleep 3 hours before my flight….RIGHT NOW and I can still get 2.75 hours…1.5 hours….” but it definitely happened.

I don’t drink caffeine. I exercise. I bought a new age aromatherapy diffuser and something helpfully called “Serenity Now” to put into it. I got an air purifier, a new mattress and great sheets.

But no matter what I try, I am a terrible sleeper.

I’ve concluded that it must have something to do with stress. I do spend an inordinate amount of time thinking about life, the universe and everything, so perhaps that’s my problem.

So in honor of my 46th year on the planet, I decided to compile a list of the top 46-investment related things I worry about at night. They do say admitting the problem is the first step in solving it, after all.

In no particular order:

- $2 trillion increase in index-tracking US based funds, which leads me to…

- All beta-driven portfolios

- Short-term investment memory loss (we DID just have a 10 year index loss and it only ended in 2009…)

- “Smart” beta

- Mo’ Robo – the proliferation (and the dispersion of results) of robo-advisors

- Standard deviation as a measure of risk

- Mandatory compliance training - don’t I know not to take money from Iran and North Korea by now?

- Spurious correlations and/or bad data

- Whether my mom’s pension will remain solvent or whether I have a new roommate in my future

- Politicizing investment decisions

- Did I really just Tweet, Blog or say that at a conference?

- Focusing on fees and not value

- Robo-advisors + self-driving cars equals Skynet?

- Going through compliance courses too quickly & having to do them over again

- Short-term investment focus

- Will I ever have to wait in line for the women’s bathroom at an investment event? Ever?

- Average performance as a proxy for actual performance versus an understanding of opportunity and dispersion of returns

- The slow starvation of emerging managers

- Is my industry really as evil/greedy/stupid as it’s portrayed

- Factor based investing – I’m reasonably smart – why don’t I get this?

- Dwindling supply of short-sellers

- Government regulatory requirements, institutional investment requirements and the barriers to new fund formation

- “Chex Offenders” – financial advisors and investment managers who rip off old people (and, weirdly, athletes)

- The vegetarian option at conference luncheons – WHAT IS THAT THING?

- Seriously, does anyone actually read a 57-page RFP?

- Boxes...check, style, due diligence...

- Tell me again about how hedge fund fees are 2 & 20…

- The markets on November 9th

- The oak-y aftertaste of conference cocktail party bad chardonnay

- Drawdowns – long ones mostly, but unexpected ones, too

- Dry powder and oversubscribed funds

- Getting everyone on the same page when it comes to ESG investing or, hell, even just the definition

- Forward looking private equity returns (see also: Will my mom’s pension remain solvent)

- Will my investment savvy and sarcasm one day be replaced by a robot (see also: Mo’ Robo)

- After the election, will my future investment jobs be determined by my membership in a post-apocalyptic faction chosen by my blood type?

- How many calories are in accountant-provided, conference giveaway tinned mints? (See also: conference chardonnay)

- Why are financial advisors who focus on asset gathering more successful than ones that focus on investment management? #Assbackward

- Dunning Krueger, the Endowment Effect and a whole host of ways we screw ourselves in investment decision making

- Why divestment is almost always a bad idea

- Active investment managers – bless their hearts – they probably aren’t sleeping any better than I am right now

- Clone, enhanced index and replication funds – why can’t we just K.I.S.S.

- The use of PowerPoint should be outlawed in investment presentations. Like seriously, against the actual law - a taser-able offense.

- Will emerging markets ever emerge?

- Investment industry diversity – why is it taking so looonnnnggg?

- Real estate bubbles – e.g. - what happens to Nashville’s market when our hipness wears off? And is there a finite supply of skinny-jean wearing microbrew aficionados who want to open artisan mayonnaise stores that could slow demand? Note to self, ask someone in Brooklyn….

- Did anyone even notice that hedge funds have posted gains for seven straight months?

Yep, looking at this list it’s little wonder that sleep eludes me. If anyone can help alleviate my “invest-istential” angst, I’m all ears. In the meantime, feel free to suggest essential oils, soothing teas and other avenues for getting some shuteye.

Sources and Bonus Reading:

Asset flows to ETFs: https://www.ft.com/content/de606d3e-897b-11e6-8cb7-e7ada1d123b1

Recent HF Performance (buried) http://www.valuewalk.com/2016/10/hedge-fund-assets-flows/

HF Replication: http://abovethelaw.com/2016/10/low-cost-hedge-fund-replication-may-threaten-securities-lawyers/

Average HF Fees: http://www.opalesque.com/661691/Global_hedge_funds_slicing_fees_to_draw_investors169.html

Political Agendas & Investing: http://www.njspotlight.com/stories/16/10/03/murphy-adds-plank-to-platform-no-hedge-funds-in-pension-and-benefits-system/

Asset Gathering vs. Investment Mgmt: http://wealthmanagement.com/blog/client-focused-fas-more-profitable-investment-managers

World's Largest PE Fund: http://fortune.com/2016/10/15/private-equity-worlds-largest-softbank/

Spurious Correlations: http://www.bloomberg.com/news/articles/2016-10-14/hedge-fund-woes-after-u-s-crackdown-don-t-surprise-sec-s-chair

Short-Term Thinking - 5 Months Does Not Track Record Make: http://www.cnbc.com/2016/10/14/venture-capitalist-chamath-palihapitiyas-hedge-fund-is-outperforming-market.html

For the last several weeks, I've been watching what I eat. After months of travel and often substituting the contents of my minibar for dinner, I had grown concerned that my bloodstream was permanently clogged with Pringle fragments. So I bought some actual fruits and vegetables (goodbye, scurvy!) and sat down to eat something that didn’t start its life behind a Chipotle counter.

Now, me being me, of course I did my research first, only to discover that I seem to have cognitive dissonance when it comes to portion sizes. I expected that a portion of beef is the literal half-cow that I receive on a plate at Del Frisco’s, when instead it is 3 ounces, smaller than a deck of cards. What. The. Actual. Hell? I felt gypped. I felt bitter. I felt hungry, no make that HANGRY.

But a week later, after sticking to my original plan, I realized I felt full, energetic and, well, maybe even kind of skinny. Maybe the problem wasn't with the reality of eating, but with my perception of what it should be. Hmmmm.

And then I started thinking about investing, and how investors and fund managers seem to be facing similar issues. No, I don’t mean that those pants make y’alls butts look fat. I mean that there seems to be some serious mismatches between what fund managers and investors expect from one another, almost guaranteeing that one (or both sides) will end up disappointed.

So in the spirit of the newly converted (quick, ask me how many calories a banana has!), here are a few ways that investment industry participants can better get along.

Investor Expectation #1: My fund managers should never lose money.

Reality: I’ve said it before and I’ll say it again – Continuous outperformance is a myth. No fund manager walks on water, is always right at the right time, or is even always right. No money manager can control for the unknown unknowns, and occasionally even the known unknowns can bite them in the tushie. The key is not to look for managers who never experience a drawdown (um, let’s remember money manager Bernie Madoff only posted one loss in his career) but for fund managers who can mitigate, manage and learn from losses, as well as be candid and proactive about addressing them.

Money Manager Expectation #1: My fund is AWESOME and yet no one gives me money. Jerks.

Reality: Your fund may be awesome, but if you aren’t getting assets, there has to be a reason. Maybe you don’t have the right network. Maybe you’re not targeting the right investors. Maybe your strategy isn’t in vogue right now. Maybe the investors you’re targeting are fully committed at the moment. Maybe you don’t mind a fair amount of volatility but other folks do. Maybe you have more faith in your simulated track record than others. Maybe you’re just too small/don’t have the right infrastructure at the moment and therefore folks can’t commit meaningful capital. The list of reasons why you’re not getting capital can be endless. Rather than dwelling on how shortsighted investors must be to overlook your fund, perhaps the best use of time would be figuring out why assets aren’t flowing in your direction and developing a plan to address those issues.

Investor Expectation #2: Money managers shouldn’t make money from the management fees.

Reality: While it’s generally accepted these days that a fund’s management fee shouldn’t be a bonanza annuity for any manager, it is also generally accepted (though sometimes forgotten) that running an investment fund takes moola. You have to be able to attract and pay talent a base salary in good times and bad. You need ample staff for your particular investment strategy. You may need research, IT, and other services. You’ve got to keep the lights on, the firewalls up and disaster recovery plans in place. How much this costs depends on strategy, location, number of investors, staffing requirements and a host of other factors. It’s up to the fund managers and investors (during due diligence) to determine a fund’s true “bottom line” and pay fees accordingly. Rarely will they be “zero.”

Money Manager Expectation #2: Investors should have infinite time to talk to me about my fund.

Reality: There are generally eight to 10 hours in an investor’s working day. The investors that I speak to often get 20 to 100 emails and calls a day from fund managers. You start doing the math. Oh, and make sure you factor in committee meetings, travel, PowerPoint presentations, conference calls, HR, compliance tutorials, and bathroom breaks. Now do you understand why it took Issac Investor a few days (or a few emails) to get back to you? Or why they only want to chat for minutes, rather than hours, about your fund? To quote The Karate Kid, “Patience, Daniel-San.”

Investor Expectation #3: There’s only one way to be “institutional.”

Reality: As much as we want a “check the box” solution for fund evaluation, it will never exist. Just because a fund manager has a full time Chief Compliance Officer, Chief Operations Officer, Chief Financial Officer, and Chief Information Officer doesn’t necessarily make that fund better than one that has combined or even outsourced some of those functions. Different levels of staffing and infrastructure will be appropriate at different stages of fund evolution and for different strategies. The key is to determine if key functions are covered adequately, not to count C-Suite professionals in the org chart.

Money Manager Expectation #3: Anyone can be a fund marketer.

Reality: Some folks are great at initiating contact with investors, making a concise and compelling case for a fund, pushing gently for follow up and asking for (and getting) a commitment. Some people aren’t. If you aren’t one of those people (see also, Money Manager Expectation Number 1), even if it is your fund and you know it better than anyone else ever could, you should consider delegating those tasks.

What are your “favorite” expectation/reality gaps between investors and fund managers? Sound off in the comments below while I go eat some celery.

Ever since that mawkish movie starring Jack Nicolson and Morgan Freeman came out in 2007, it seems people can’t stop talking about their “bucket lists”. There have been songs written about the topic (“I went 2.7 seconds on a bull named Fu Man Chu...”), Internet memes created, and the phrase has completely wormed its way into our day-to-day chatter (Ooooh! Going to Thailand is totally on my bucket list!).

In full disclosure, I actually hate both the phrase and the concept of a bucket list. I try to do and say the things I want in the moment, rather than wait for my impending death to be a motivating factor. Right now, the only things on my bucket list are 1) get a tattoo (impending death will remove my long-term tattoo commitment-phobia); and 2) write a salty tell-all about the investment industry that is equal parts Bridget Jones Diary, The Office and Game of Thrones.

With that last goal in mind, some of you out there should be wishing me good health and longevity every darn day. But I digress.

Based on my knowledge of human behavior, I can’t say I’m surprised about our love of the bucket list. We love, love, love to put things in buckets and boxes and to create certainty where there is none. Studies have shown that uncertainty actually causes more stress than actual pain. And, after all, what’s more uncertain than death? So if having prescribed list makes someone feel better about their inevitable demise, maybe it's not all bad, but it is just a coping mechanism.

Perhaps that also explains our utter fascination with putting investments into buckets. Small Cap, All Cap, SMID Cap Growth. Early Stage, Seed Stage, Growth Stage. Event Driven, Special Situations, Trend Following. Whatever the investment strategy, investors look for ways to group supposedly “like” managers together to streamline the investment process.

But does that actually help or hurt us?

Putting investments in boxes is theoretically easiest in the long-only world. After all, we have ACTUAL boxes in which to put investments thanks to Morningstar. No matter what a manager does, they usually comfortably squeeze into a pre-defined style box, giving investors not only information on what the fund does, but also on how it does, thanks to agreed-upon benchmarks.

But is looking for managers in those boxes to an investors benefit? Martijn Cremers of Notre Dame says “no.” In his analysis of long-only managers he found that the more a manager fits into a box, the more certain an investor could be of one thing: failure. Not surprisingly, benchmark huggers have little opportunity to outperform their, um, benchmark, since they may be holding the same stocks in the same amounts within their funds. So instead of looking for these closet indexers, who make us feel certain and warm and secure (and later, ultimately, poor), Cremers argues investors should be looking for managers who have 40% or less of their holdings in common with their benchmark, and that hold any common holdings in different proportions. While this doesn’t guarantee outsized returns, at least it opens the door to them.

And the bucket story is similar in the alternative investment world.

If I had a dollar for every time an investor or researcher tried to shoehorn a hedge fund into a specific investment bucket, I could probably take time off to write my tell-all.

But the thing about hedge fund strategy buckets is that they are pretty craptastic. It is nigh on impossible for a database or index provider to provide enough granularity into strategies without overwhelming users with a huge number of strategy categories. Historically, the number of hedge fund "buckets" has ranged from a low of about 9 to a high of 100. The former ends up lumping very disparate funds together and the latter is too complex for the average investor to utilize. The result? An imperfect system that, if taken as gospel, can bite an investor in the arse.

Take, for example, a hedge fund I know well that trades across the capital structure in distressed companies. One group put them in the Distressed bucket. One group put them in Event Driven. One group put them in Multi-Strategy.

Which group is right?

Well, all of them. And none of them.

Hedge fund strategy buckets are catch-alls. They are designed to create some amount of cosmos from chaos, but laser accuracy isn’t their strong suit. You can have all sorts of nuance within a broad category like Equity Hedge, just like you can have all sorts of nuance within a single fund. And no, that’s not “style drift.”

So let’s say an investor decides to look for an Event Driven fund. In their dataset, the fund above is classified as Distressed. They do their search and the fund never pops up, even though it could be just what the investor is looking for. How does that help anyone?

It doesn’t.

And let’s say that a hedge fund is classified within a certain strategy bucket but has a more nichey or nuanced, or even totally unrelated strategy. They may get benchmarked to their strategy bucket, which ultimately has little to do with how the fund actually invests. An investor who relies too heavily on that information could make poor investment or redemption decisions, too.

Again, not helpful.

So I guess I can add one more thing to my bucket list – kicking the (strategy) buckets. While I admit they are probably here to stay, I urge investors to take them with a large grain of salt, perhaps even a salt lick-sized grain. If you must use strategy boxes or buckets or Rubbermaid containers in your investment process, be sure to search adjacent or related strategies when looking for managers. Create blended or custom benchmarks. Don’t let benchmarks make investment decisions. Allow room for nuance and opportunity.

In other words, use buckets the way God intended – for ice and a nice bottle of bubbly and use that to help accept that a little uncertainty can be a good thing.

https://www.sciencedaily.com/releases/2016/03/160329101037.htm

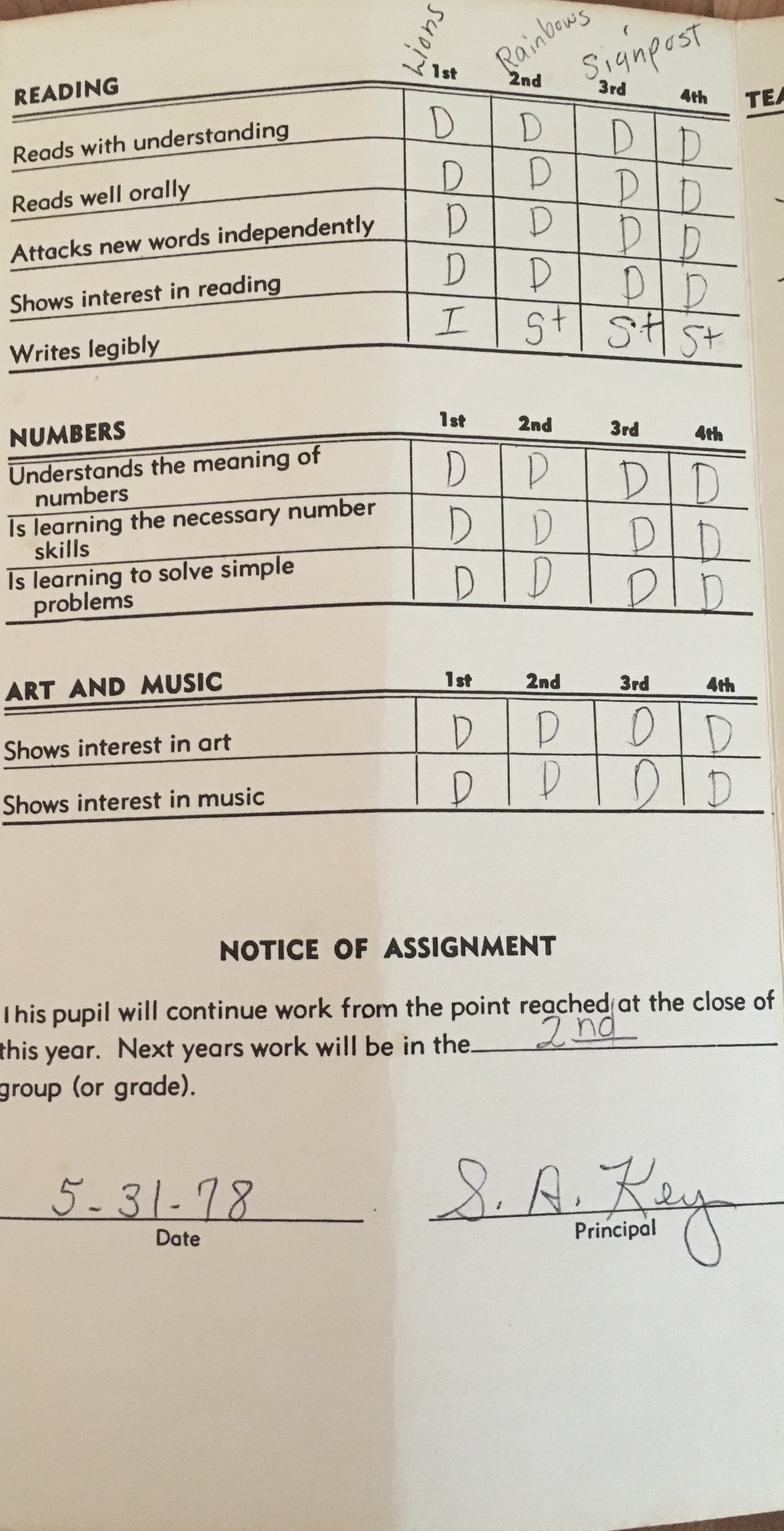

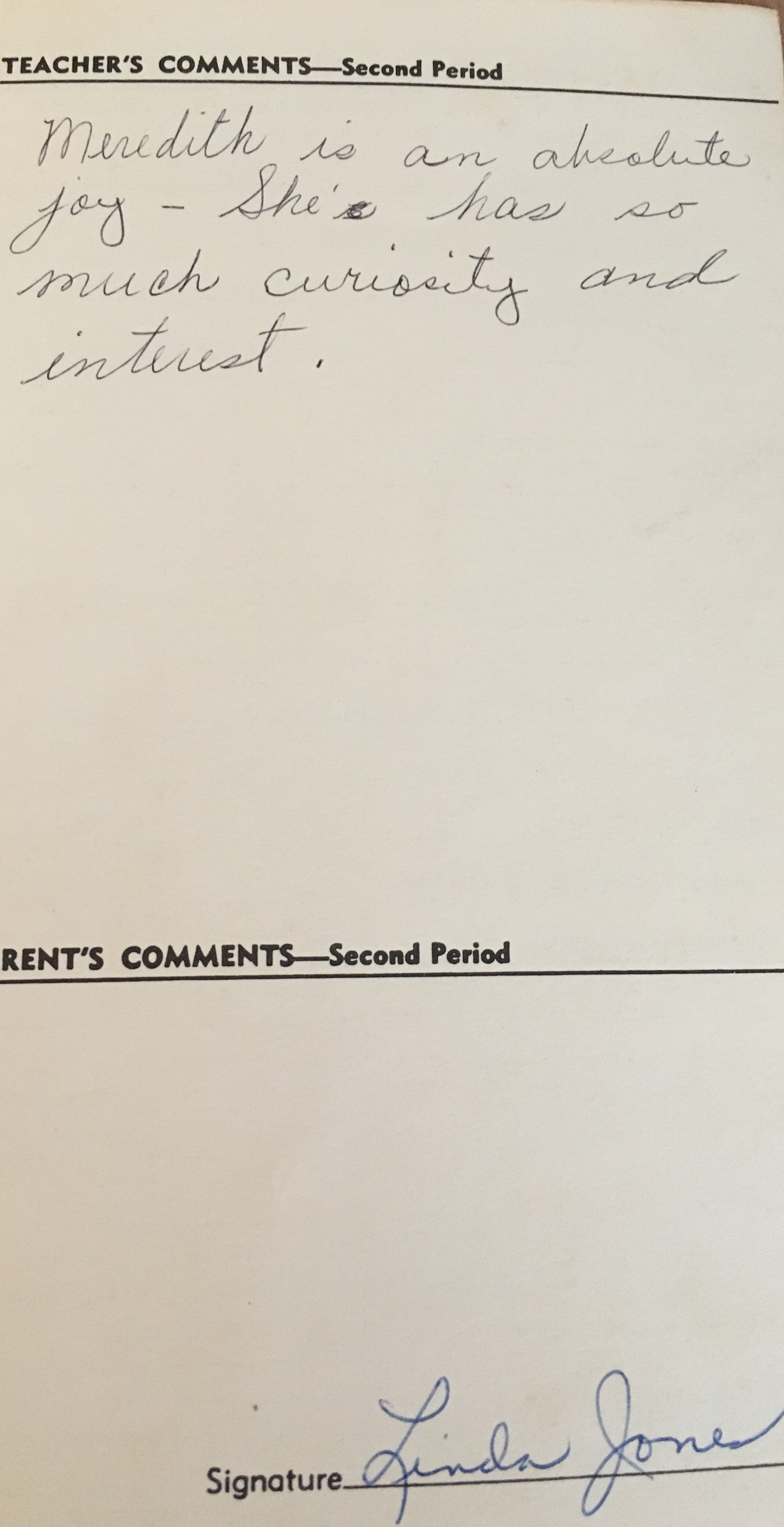

I was going through some old papers recently and, lo and behold, stumbled across my first grade report card. Since I’ve often struggled with authority figures, I opened it with some trepidation and discovered a few tidbits about the past.

- Much like many employers today, achieving a rating of “outstanding” was impossible by Mrs. Northem’s standards, and is likely the genesis of my overachievement urges.

- Grades were not merely the results of tests and homework, as they became as I got older, but a more nuanced measure of success.

- My teacher (and the ones that followed) seemed to actually like me, with Mrs. Northem writing “Meredith is an absolute joy. She has so much curiosity and interest.”

Now, as one of my friends of course pointed out, the end of that sentence could have been left off. He contends that my teacher merely stopped writing before she added: “She has so much curiosity and interest…that I want to slap her.”

But still.

This little archeological gem made me start thinking about how we grade money managers. We all talk about their collective Grade Point Average (performance) but we tend to get stalled after that.

For example, consider the headlines that of late argue hedge fund managers have generated poor performance, particularly relative to their fees.

What does that mean, exactly?

Let’s assume that means that the average hedge fund has essentially a “C” GPA. If there are five funds (because the math is easy), what grades did each fund make?

- 3 A’s and 2 F’s

- 3 A’s and 2 D’s

- 4 B’s and 1 F

- 5 C’s

- 4 C’s and 1 D

For some reason, financial pundits seem to think the answer has to be either 4 or 5, when, in fact, every combination of the grades above would generate that C average.

While certainly Garrison Keillor can’t be right when he quips “all our children are above average,” it is important to remember that when we talk about average performance some funds, potentially a great many funds, will have performed above that average, while others will have performed below the average. It’s math, y’all.

But before we even get too tied up in our numeric underpants, let’s also consider that the “grades” we give our managers are not as simple as a single performance number.

Just like my reading “grade” was comprised of understanding, reading aloud, attacking new words, interest and writing, in which I earned “D”oes good work across the board (with the exception of writing…I’ve always had the handwriting of a serial killer), how we measure managers is, or should be, comprised of a number of different factors.

- Did the manager perform as expected? Not every manager or strategy will perform well in every market. If, however, the fund performed as we expected given the prevailing market and strategic considerations, that should be taken into consideration. For example, marking down a short seller for not generating eye-popping positive returns during a raging bull market is insanity and a push towards style drift.

- Is the manager taking the risk I expect him to take? If a fund manager starts taking increasing risk with your capital as they chase some illusive performance benchmark, that’s more cause for concern in my book than underperformance.

- Does the manager communicate effectively? Do you have sufficient transparency and frequent updates so you can evaluate how you feel about items 1 and 2?

- How does the manager’s performance fit into my overall portfolio? No fund is an island, but is instead part of an overall asset allocation plan. Managers and strategies should contribute when you expect them to (see above), but again, constant outperformance is more of a myth.

Perhaps because much of the media doesn’t get the full picture, or perhaps because, like me, they’re a bit removed from their old report cards, too many folks become entirely too fixated on manager GPA. Unfortunately, that leads those less familiar with investing to potentially make decisions based on this all-too-linear thinking as well, perhaps even ignoring investments that could have a positive impact on their overall portfolio because they are “bad.”

And that’s really the shame, here. Because if we look behind the manager “grades” we would see that many investors, two-thirds in fact, believe their hedge fund investments actually met or exceeded their expectations in 2015, according to Preqin data.

Which means that either more than half of our industry suffers from the “Lake Woebegone Effect” (all my managers are above average) or there is more to the story than simple average performance.

As someone who “D”id good work with numbers, even back in 1978, I’m betting it’s the latter.

Please note: My blog is now published on the first and third Tuesday of each month.

As y’all recover from the excesses of fried turkeys, stuffed stockings, too much ‘nog and an overdose of family time, it seems like a good time to catch up on some light reading. So, in case you missed them, here are my 2015 blogs arranged by topic so you can sneak in some snark before you ring in the New Year.

Happy reading and best wishes for a joyous, profitable, and humorous 2016.

Happy Holidays from MJ Alts!

HEDGE FUND TRUTH ANIMATED SERIES

http://www.aboutmjones.com/mjblog/2015/6/29/hedge-fund-truth-series-hedge-fund-fees

http://www.aboutmjones.com/mjblog/2015/6/1/the-most-hated-profession-on-earth

http://www.aboutmjones.com/mjblog/2015/3/2/the-hedge-fund-truth-launching-and-running-a-small-fund

http://www.aboutmjones.com/mjblog/2015/1/19/savetheemergingmanager

WOMEN AND INVESTING

http://www.aboutmjones.com/mjblog/2015/12/13/dear-santa

http://www.aboutmjones.com/mjblog/2015/11/16/not-so-fast-times-at-hedge-fund-high

http://www.aboutmjones.com/mjblog/2015/9/25/doing-well-doing-good-improving-investment-diversity

http://www.aboutmjones.com/mjblog/2015/7/26/the-evolution-of-a-female-fund-manager

http://www.aboutmjones.com/mjblog/2015/6/10/advice-to-the-future-women-of-finance

http://www.aboutmjones.com/mjblog/2015/4/27/diversification-and-alpha-by-the-book

http://www.aboutmjones.com/mjblog/2015/1/26/dont-listen-to-greg-weinstein

EVERYONE HATES ALTERNATIVE INVESTMENTS (ESPECIALLY HEDGE FUNDS)

http://www.aboutmjones.com/mjblog/2015/12/7/keen-delight-in-the-misfortune-of-hedge-fundsand-me

http://www.aboutmjones.com/mjblog/2015/2/2/mfp1glk0exk0vlnqtpx6lby2ba9z8n

http://www.aboutmjones.com/mjblog/2015/11/23/babelfish-for-hedge-funds-1

http://www.aboutmjones.com/mjblog/2015/11/8/hedge-funds-bad-reputation

http://www.aboutmjones.com/mjblog/2015/10/5/dear-hedgie

http://www.aboutmjones.com/mjblog/2015/9/9/investment-professional-fact-fiction-the-business-trip

http://www.aboutmjones.com/mjblog/2015/5/17/hedge-funding-kindergarten-teachers

http://www.aboutmjones.com/mjblog/2015/4/14/are-hedge-clippers-trimming-up-the-wrong-tree

http://www.aboutmjones.com/mjblog/2015/2/16/rampallions-scullions-hedge-funds-oh-my

FUND RAISING & INVESTOR RELATIONS

http://www.aboutmjones.com/mjblog/2015/6/22/swingers-and-the-art-of-investor-communication

http://www.aboutmjones.com/mjblog/2015/4/5/7-secrets-to-a-successful-fund-elevator-pitch

http://www.aboutmjones.com/mjblog/2015/10/26/founding-funders

http://www.aboutmjones.com/mjblog/2015/8/28/crisis-communication-for-investment-managers

http://www.aboutmjones.com/mjblog/2015/7/20/trust-me-im-a-portfolio-manager

http://www.aboutmjones.com/mjblog/2015/5/4/the-declaration-of-fin-dependence

EMERGING MANAGERS

http://www.aboutmjones.com/mjblog/2015/8/17/people-call-me-a-skeptic-but-i-dont-believe-them

http://www.aboutmjones.com/mjblog/2015/10/19/are-you-the-next-blackstone-dont-count-on-it

DUE DILIGENCE

http://www.aboutmjones.com/mjblog/2015/11/1/the-evolution-of-due-diligence

http://www.aboutmjones.com/mjblog/2015/8/6/a-little-perspective-on-the-due-diligence-process

GENERAL INVESTING INSIGHTS

http://www.aboutmjones.com/mjblog/2015/10/11/investment-wisdom-increases-with-age-dance-skills-dont

http://www.aboutmjones.com/mjblog/2015/8/24/the-love-of-the-returns-chase

http://www.aboutmjones.com/mjblog/2015/8/2/slamming-the-wrong-barn-door

http://www.aboutmjones.com/mjblog/2015/6/8/the-confidence-hubris-conundrum

http://www.aboutmjones.com/mjblog/2015/5/10/the-crystal-ball-in-the-rearview-mirror

http://www.aboutmjones.com/mjblog/2015/2/23/pattern-recognition-may-make-you-poorer

http://www.aboutmjones.com/mjblog/2015/1/5/new-years-resolutions-for-investors-managers-part-one

What do you want to read about in 2016? List topics you enjoy or would like to see more of in the comments section below.

In the meantime, gird your loins for the blog that always parties like it’s 1999, even when it’s 2016.

And please follow me on Twitter (@MJ_Meredith_J) for daily doses of research, salt and snark.