For the last several weeks, I've been watching what I eat. After months of travel and often substituting the contents of my minibar for dinner, I had grown concerned that my bloodstream was permanently clogged with Pringle fragments. So I bought some actual fruits and vegetables (goodbye, scurvy!) and sat down to eat something that didn’t start its life behind a Chipotle counter.

Now, me being me, of course I did my research first, only to discover that I seem to have cognitive dissonance when it comes to portion sizes. I expected that a portion of beef is the literal half-cow that I receive on a plate at Del Frisco’s, when instead it is 3 ounces, smaller than a deck of cards. What. The. Actual. Hell? I felt gypped. I felt bitter. I felt hungry, no make that HANGRY.

But a week later, after sticking to my original plan, I realized I felt full, energetic and, well, maybe even kind of skinny. Maybe the problem wasn't with the reality of eating, but with my perception of what it should be. Hmmmm.

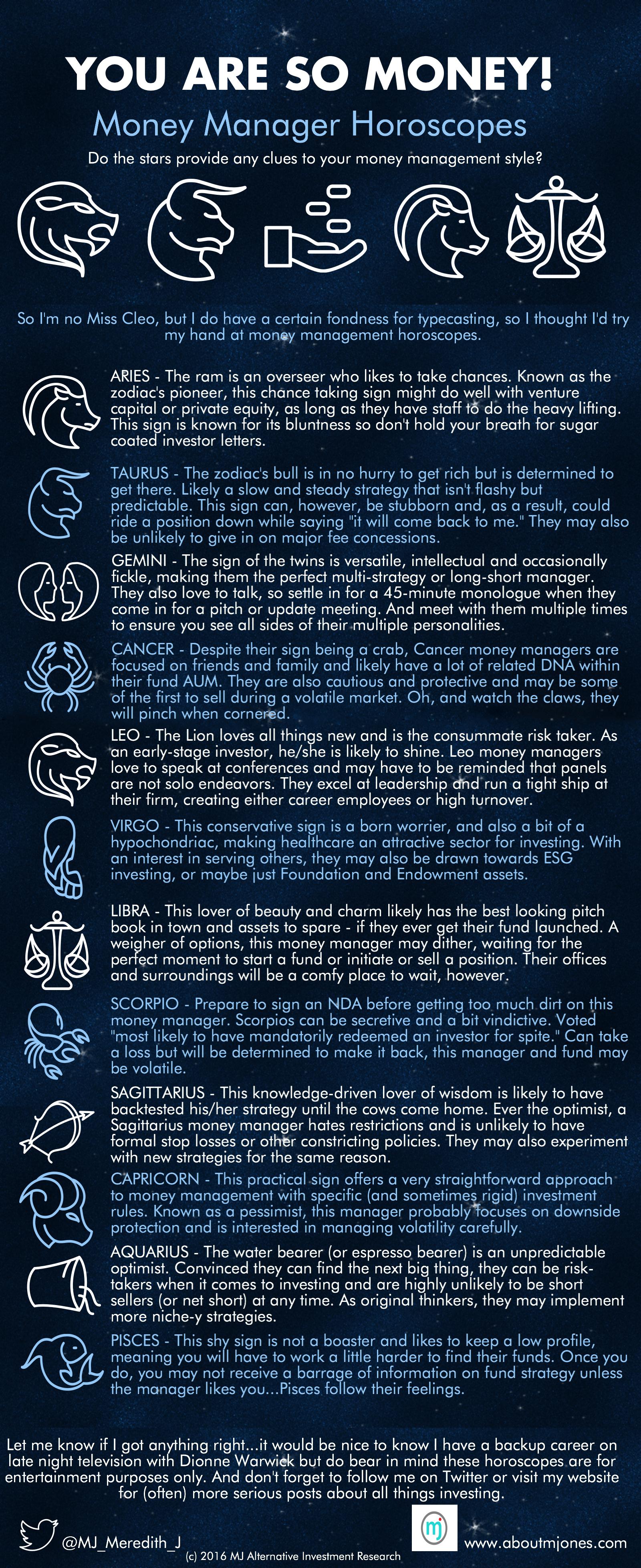

And then I started thinking about investing, and how investors and fund managers seem to be facing similar issues. No, I don’t mean that those pants make y’alls butts look fat. I mean that there seems to be some serious mismatches between what fund managers and investors expect from one another, almost guaranteeing that one (or both sides) will end up disappointed.

So in the spirit of the newly converted (quick, ask me how many calories a banana has!), here are a few ways that investment industry participants can better get along.

Investor Expectation #1: My fund managers should never lose money.

Reality: I’ve said it before and I’ll say it again – Continuous outperformance is a myth. No fund manager walks on water, is always right at the right time, or is even always right. No money manager can control for the unknown unknowns, and occasionally even the known unknowns can bite them in the tushie. The key is not to look for managers who never experience a drawdown (um, let’s remember money manager Bernie Madoff only posted one loss in his career) but for fund managers who can mitigate, manage and learn from losses, as well as be candid and proactive about addressing them.

Money Manager Expectation #1: My fund is AWESOME and yet no one gives me money. Jerks.

Reality: Your fund may be awesome, but if you aren’t getting assets, there has to be a reason. Maybe you don’t have the right network. Maybe you’re not targeting the right investors. Maybe your strategy isn’t in vogue right now. Maybe the investors you’re targeting are fully committed at the moment. Maybe you don’t mind a fair amount of volatility but other folks do. Maybe you have more faith in your simulated track record than others. Maybe you’re just too small/don’t have the right infrastructure at the moment and therefore folks can’t commit meaningful capital. The list of reasons why you’re not getting capital can be endless. Rather than dwelling on how shortsighted investors must be to overlook your fund, perhaps the best use of time would be figuring out why assets aren’t flowing in your direction and developing a plan to address those issues.

Investor Expectation #2: Money managers shouldn’t make money from the management fees.

Reality: While it’s generally accepted these days that a fund’s management fee shouldn’t be a bonanza annuity for any manager, it is also generally accepted (though sometimes forgotten) that running an investment fund takes moola. You have to be able to attract and pay talent a base salary in good times and bad. You need ample staff for your particular investment strategy. You may need research, IT, and other services. You’ve got to keep the lights on, the firewalls up and disaster recovery plans in place. How much this costs depends on strategy, location, number of investors, staffing requirements and a host of other factors. It’s up to the fund managers and investors (during due diligence) to determine a fund’s true “bottom line” and pay fees accordingly. Rarely will they be “zero.”

Money Manager Expectation #2: Investors should have infinite time to talk to me about my fund.

Reality: There are generally eight to 10 hours in an investor’s working day. The investors that I speak to often get 20 to 100 emails and calls a day from fund managers. You start doing the math. Oh, and make sure you factor in committee meetings, travel, PowerPoint presentations, conference calls, HR, compliance tutorials, and bathroom breaks. Now do you understand why it took Issac Investor a few days (or a few emails) to get back to you? Or why they only want to chat for minutes, rather than hours, about your fund? To quote The Karate Kid, “Patience, Daniel-San.”

Investor Expectation #3: There’s only one way to be “institutional.”

Reality: As much as we want a “check the box” solution for fund evaluation, it will never exist. Just because a fund manager has a full time Chief Compliance Officer, Chief Operations Officer, Chief Financial Officer, and Chief Information Officer doesn’t necessarily make that fund better than one that has combined or even outsourced some of those functions. Different levels of staffing and infrastructure will be appropriate at different stages of fund evolution and for different strategies. The key is to determine if key functions are covered adequately, not to count C-Suite professionals in the org chart.

Money Manager Expectation #3: Anyone can be a fund marketer.

Reality: Some folks are great at initiating contact with investors, making a concise and compelling case for a fund, pushing gently for follow up and asking for (and getting) a commitment. Some people aren’t. If you aren’t one of those people (see also, Money Manager Expectation Number 1), even if it is your fund and you know it better than anyone else ever could, you should consider delegating those tasks.

What are your “favorite” expectation/reality gaps between investors and fund managers? Sound off in the comments below while I go eat some celery.