A few weeks ago, I put out the call on Twitter that I wanted to write an investment manager agony column. Of course, in the deluge of Mad King tweets that seem govern both foreign and domestic affairs of late, that call went largely unnoticed. I was beginning to agonize over the general lack of agony when I heard a primal scream from the darkness - otherwise known as a Twitter DM.

“WHY CAN’T I RAISE ANY ASSETS????”

This, of course, is one of the most pervasive forms of investment manager agony, so I decided to tackle the question, using my own misery as my guide. You see, as a single woman in my 40s, I know all too well the frustration that comes from looking tirelessly for something that proves to be incredibly elusive. In my case, I’ve turned to the modern-day Wizard of Oz, otherwise known as the Internet, to try to solve my dating dilemma. I mean, we’ve all heard stories of our friend’s cousin’s sister Becky who is happily married with two kids to a guy she met on Tinder, right?

After a few months of my recent Internet experience, I remain convinced that there are good matches out there, although perhaps not in Nashville, which seems to be the dead fish picture capital of the world. I mean, one of my governing theories about dating and fund raising is that there is, in fact, a lid for every pot, so I refuse to admit defeat.

BUT I remain even more convinced that there are some super obvious giveaways that maybe this one ain’t “the one.”

So, Dear Random Twitter Fund Manager, I propose to you that perhaps you’re quite the investment catch, and you just haven’t met the right investor who can make all your dreams come true.

Or you may be like one of these folks that pop up in my dating feed from time to time, in which case buckle up, Buttercup - you’re probably in for a bumpy ride.

Look, if you’re newly separated from your prior firm and you don’t have a great, audited and portable track record to vouch for you, many investors are going to have trouble getting involved. I mean, you could prove pretty unstable, you know?

I don’t want to insult the vertically challenged, but I have a hard and fast rule that I won’t date anyone shorter than me. I mean, I’m 5’3” for Pete’s sake. It shouldn’t be that hard for an adult male to be taller than that. I just have this horrible mental image of my (potential) boyfriend’s jeans being smaller than mine that I can’t get over. And it is not hot.

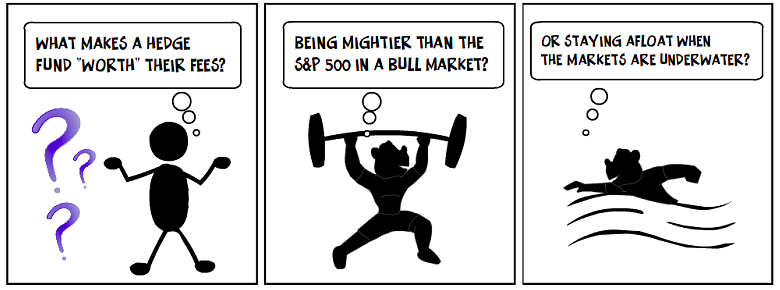

Like me, many investors have trouble getting past a fund that is just too small. It may be that they have an investment policy statement that says they can’t be more than 10% or 15% of your assets, which makes the allocation (and the time for due diligence) just not worth it. It may be that they worry about the business risk or how you’ll support the firm when performance isn’t great. Whatever it is, move on. There ARE folks that will find your size appealing, from seeders to Managers of Managers. Swipe right on them instead.

It has taken me a while, but I’ve finally learned that people who put NO DRAMA in all caps ALWAYS bring the drama. Always. And if you’re bringing the drama to investors in the form of volatility, crazy headlines, drawdowns or worse, they’re going to figure that out, too, and run in the opposite direction.

I hesitated to use a picture from my own “dating” experience, but given the anonymity factor in this photo, I figured I was safe. Seriously, y’all, this guy popped up for both me and a friend recently, leaving both of us to wonder “Is this a joke?!”

Maybe your fund marketing efforts don’t involve a Santa hat, but all the same, maybe you’re still not taking your marketing seriously. Do you have a high quality marketer on board? If you are doing your own marketing, have you reviewed your successes and failures to figure out what to do differently? Do you have a compelling pitch book? Do you go to enough conferences without going to ALL the conferences? If you don’t take marketing seriously, and by that I mean treat it as if it were a legitimate part of your business, how do you expect money to flow in?

I actually had to look this up the first time I saw it. Evidently, there’s a whole crop of folks out there who think that if their significant other knows they’re being cheated on, it’s all good. Sorry, folks, but that’s just creepy. And weird. And off-putting. And perhaps your firm is perfectly happy calling an investor your one and only, but there may be something else slightly creepy and weird about your firm that is off-putting in its own way. Is your spouse or child a major player in the firm? That’s not a deal breaker for some folks, but it does raise the issue of controls. Do you have a third, fourth or fifth-tier auditor? Maybe you’re saving money, or maybe you’re hiding something (hello Bernie Madoff!). Have you had a lot of staff turnover in the life of the fund? Could be growing pains, or it could be you are hell to work with. Look at EVERYTHING in your fund the way an outsider would and ask yourself “Is this an easy tick box or does it raise some significant questions?” At the very least, be prepared to do some explaining in a meeting/due diligence process. At best, consider what you can do to mitigate the creepy factor soonest.

On the one hand, I have to admire this guy’s confidence. On the other much larger hand: euuuuwwwwww.

Likewise, confidence in investing is a good thing. But thinking you’re all that and perhaps talking in overly technical terms, charging fees that aren’t justified by your track record or strategy or acting like you’ll never have a loss is incredibly off-putting. And to be honest, this is often the subject of investor post cocktail banter at conferences.

So, Dear Random Twitter Fund Manager, I hope this helps to explain your marketing conundrum. And may the coming months bring you the satisfying relationship that I deserve.

In the meantime, if you have an investment manager (or investor) agony question I can “help” with, please don’t hesitate to reach out.